Up until the US invasion in 1989, Panama was the premier off-shore jurisdiction but the BVI came to prominence after that event. The British Virgin Islands (BVI) is often called the grandfather of all IBCs. IBC stands for “international business company,” originally from the International Business Companies Act of 1984 in the British Virgin Islands. It has since been copied—with slight variations—across many jurisdictions.

For so many international entrepreneurs, the BVI is now the go-to jurisdiction for an offshore company. When asked why the BVI? Most entrepreneurs would probably say that it’s because it’s a well-known or popular jurisdiction. Almost a synonym for an offshore company. But is it worth it?

How does it work

The United Kingdom in general and the City of London in particular, has long been considered a global financial center. Today London is rivaled only by New York City as far as financial hub cities go. This helps explain the popularity of the BVI. On one hand this overseas territory is a part of the United Kingdom. On the other hand, it is a semi-autonomous region which allows it to craft its own unique laws and financial regulations.

Companies and wealth managers who choose to offshore to the BVI get to enjoy the reputation and supervision of the United Kingdom, while also tapping into favorable offshoring regulations. English is the official language, it uses the US dollar and is an ideal location for Americans looking to offshore.

Pros

- Taxation – There is no corporate tax in BVI. The only taxes are in practice only paid by locally run companies with local employees. If you incorporate in BVI and have no local operations, you may not need to pay these taxes.

- Public Records – Companies owned by nonresidents rarely register for the public records. The government does not know who the directors and shareholders of companies are. That information stays with the registered agent, which is bound by law to only disclose the information under a lawful request such as through a DTA or a Tax Information Exchange Agreements (TIEA).

- No Taxes but Accounting Requirements remain – The BVI has no corporate income tax, customs duties, wealth tax, or VAT. Nevertheless companies are required to maintain proper records and prepare annual accounts. Accounts do not have to be filed and auditing is not required, but copies of the accounts must be held available for inspection.

- Only 1 Director and 1 shareholder is needed. Can be a corporate shareholder and any nationality is allowed.

- No minimum capital requirements.

Cons

- Costs – Costs are generally higher than in other IBC jurisdictions, but nonetheless highly competitive. It’s rare to find BVI incorporation fees under $1,000 USD. Expect something closer to $1,500-$3,000 with a high-quality, reputable service provider. Annual renewal fees are around $800 to $1,200 in most cases.

- Restricted activities – The following activities are not permitted for IBCs to be undertaken: offering banking or investment services to third parties; offering gambling, betting or casino services; offering insurance or reinsurance services; offering trust services to third parties.

- Reputation – The BVI’s international reputation has been impacted by recent high profile and controversial cases of tax evasion and suspected money laundering. In addition, there has been some unfavorable ratings by organizations like the OECD.

- Complicated – Setting up an IBC in the British Virgin Islands is a bit more complicated than some other offshoring hubs. All activities conducted must be legal in both your home country, and the BVI. The compliance screening usually comes up with follow up questions and the business details have to be clearly outlined. Some providers demand a full business plan.

- Offshore Banking in BVI – The banking sector in BVI is very small. Accounts are almost always opened remotely or by visiting the bank in another country. Some banks often insist on a personal visit if there is no introducer or intermediary.

Changes that have come into effect on 1 January 2023 in respect of companies in the BVI

Bearer Shares

Bearer Shares are discontinued in the BVI. Any bearer shares issued by a BVI company are now inactive with no rights and must be redeemed or exchanged for registered shares. Failure to do so can result in a fine of $50,000.00.

Register of Members

The Register of Members of a BVI company must now specify the nature of voting rights to shares, unless the same has been specified in the company’s Memorandum & Articles of Association.

Resignation of Registered Agent

Prior to 1 January 2023, where a registered agent intends to resign it was required to give the company 90 days within which to appoint a new registered agent, that time has been reduced to 60 days.

Filing of Annual Returns

A BVI company must file an Annual Return with its registered agent no later than 9 months from the end of the fiscal year. This does not apply to regulated and listed companies or companies that file annual reports with the BVI Inland Revenue Department.

Registered agents are obligated to notify the Commission should a company fail to file the annual return.

A company which is part of a group may rely on the group accounts for their submission.

The returns will not be made public.

Register of Directors

The Register of Directors of a BVI company must now include the details of alternate directors unless that alternate director is already a director of the company.

The Register of Directors of Companies will also be available when searches are conducted, thus being publicly available. The register of members continues to remain private.

Continuation Out of the BVI

A company which wishes to continue out of the BVI must now prior to continuation advertise in the BVI Gazette and on its website if it has one, notice of its intent to transfer. The Notice must also be sent in writing to its members and creditors. The notice must include the intended jurisdiction.

The company must also file with the Registrar a copy of the notice of intent confirming that notice has been provided as per the above.

A company can rescind the notice of intent by filing the same with the Registrar.

Strike Off/Dissolution of Companies

Dissolution of a Company is now automatic on the striking off of the company from the register of companies. Dissolution takes effect on the date the strike off is published in the BVI Gazette.

An aggrieved party may challenge the strike off/dissolution within 30 days of the strike off/dissolution.

This is only applicable to companies struck off after 1 January 2023 and were not voluntarily liquidated.

A company may be restored by making an application to the Registrar of Corporate Affairs for permission to be restored upon meeting certain criteria and serving the Financial Secretary. If the criterion for restoration is met then the application is approved, and the Company can then file a restoration application.

Companies will have 5 years to make such an application.

Restoration of Companies which were Voluntarily Liquidated

Companies which were voluntarily liquidated and seeking to be restored must apply to the Court.

Deemed Resignation of Registered Agent

Where a company is struck off/dissolved, the registered agent of the company is deemed to have resigned on the date of strike off/dissolution. Any application to restore the company must include a consent and declaration from a valid registered agent in the BVI prior to restoration.

Liquidators for Voluntary Liquidation

A qualified BVI resident must be appointed as liquidator or one of the liquidators of any company intending to enter voluntary liquidation. BVI liquidator will be obligated to hold all liquidation and underlying documents of the company. Voluntary liquidators appointed before 1 January 2023 can continue to act on existing liquidations until they conclude.

Companies Currently Struck Off (prior to 1 Jan 2023)

Companies which are currently struck off, or were struck off prior to 1 January 2023, must be restored on or before 30 June 2023. If the 10-year period that the company would have had before it is dissolved ends after 30 June 2023 then the company must restore by 30 June 2023. If the 10-year period would end on a date before 30 June 2023 the company must be restored on that date. If a company fails to be restored before 30 Jun 2023 or the earlier date, the company shall become a dissolved company whether the notice of its strike off is published or not.

If a company fails to be restored during that period it must apply to the court to be restored and in addition to all other fees, will be subject to a penalty of $5,000.00 unless the application is being made by a party other than a former member, director or liquidator.

Companies Currently Dissolved (prior to 1 Jan 2023)

Companies which are currently dissolved whether for non-payment of fees or voluntarily liquidated must apply to the courts within 5 years from 1 Jan 2023 to be restored or if the 7 years which they previously had to restore would be prior to 31 December 2027 then the company must apply to be restored on that date.

Fees

In addition to the above changes there has been an increase in government fees. Please see new fees below for the more common transactions:

Incorporation and Renewal of Companies

- 50,000 Shares or Less – $550

- More than 50,000 Shares – $1350

- Guarantee Companies – $550

- Private Trust Companies (50,000 Shares or less) – $1500

- Private Trust Companies (more than 50,000 Shares) – $3000

- Restrictive Companies – $8000

- Foreign Company (registration) – $550

Late fee penalty for annual fees for foreign companies 10% before 31 May and 50% after 31 May

- Certificate of Good Standing $100 (electronic) $150 (physical)

- Continuation into the BVI – $500 (50,000 shares or less) $1300

- Continuation Out of the BVI – $2500

- Notice of Intent to continue Out – $250.00

- Filing of Register of Directors – $100

- Filing of Changes to Register of Directors – $50

- Application for Restoration – within 12 months (200) outside 12 months ($400)

- Restoration once approved – within 12 months ($500) outside 12 months ($1200)

- Filing Court Order – within 12 months of dissolutions ($400.00) outside of 12 months of dissolution ($600.00)

- Court Restoration – within 12 months of dissolutions ($2000.00) outside of 12 months of dissolution ($4000.00)

Recommendation

The BVI is a recognized jurisdiction in the international financial services sector, but many are starting to opt for other Caribbean jurisdictions like Anguilla, Turks and Caicos, Cayman Islands, or even jurisdictions which aren’t British Overseas Territories, such as Mauritius or Singapore for their reputations.

In the past the BVI earned a bad reputation for money laundering, but in recent years the country has strengthened its systems and is now a part of major international agreements. But more robust compliance screening results in slightly higher costs and slower registration.

Economic Substance Requirements in the British Virgin Islands (BVI)

The BVI is among the most popular jurisdictions for offshore structures.

https://www.mooresrowland.tax/2018/05/pros-and-cons-of-bvi-entity.html

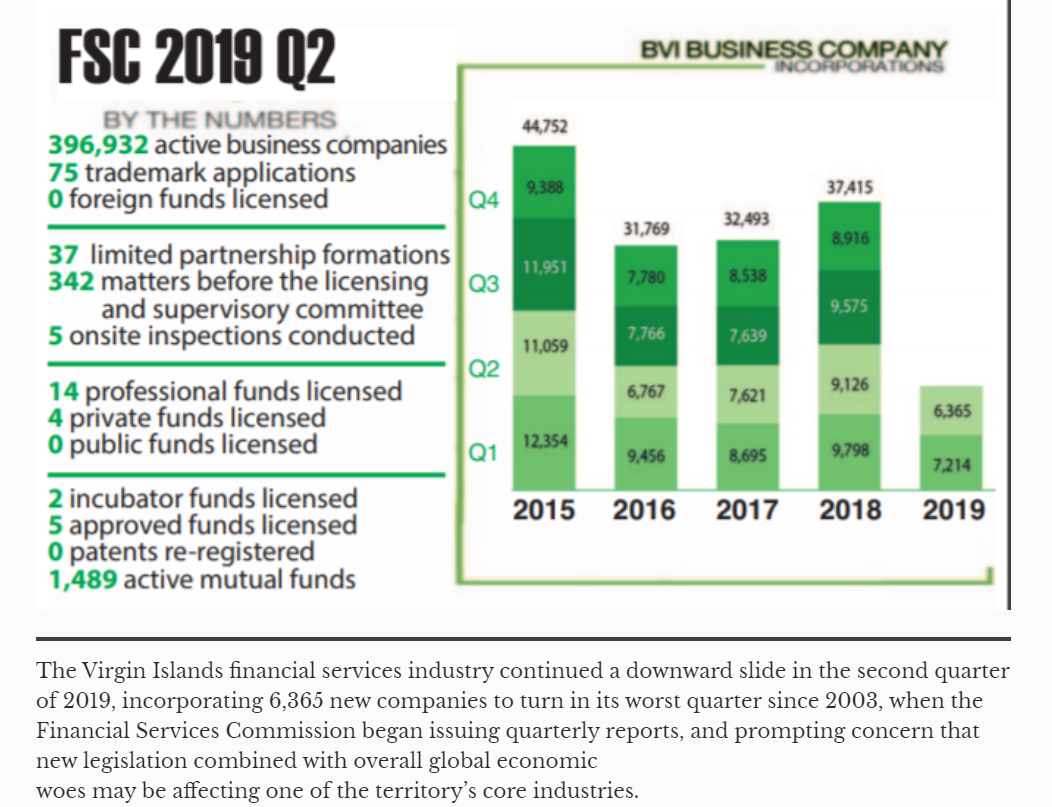

But things are changing and for a number of reasons, it is losing its appeal –

https://www.mooresrowland.tax/2017/07/bvi-secrecy-no-more.html

https://www.mooresrowland.tax/2018/05/uk-forces-overseas-territories-to-set.html

Now it seems that the new rules around substance is hitting them pretty hard –

The BVI government has introduced a new Act with Economic Substance Requirements for certain legal entities

effectively applicable from 1 January 2019, with a six-month transitional period for existing legal entities.

The legislation is introduced based on the recommendations of the BEPS project developed by the OECD to combat

tax evasion by multinationals which are shifting profits from high tax jurisdictions to entities in low/zero tax jurisdictions

but which entities have no adequate economic substance locally.

Similar legislation is introduced in other low/zero

tax jurisdictions including Cayman Islands, Mauritius, Bahamas, Bermuda, Jersey, Guernsey, Isle of Man, Aruba and

Curacao, while other jurisdictions may follow.

The ES Law applies to certain BVI companies, BVI limited partnerships with legal personality, and foreign companies and foreign limited partnerships with legal personality registered in the BVI carrying on “relevant activities”. The ES Law does not apply to limited partnerships that do not have legal personality.

Entities that are tax resident in a jurisdiction outside of the BVI (other than in a jurisdiction included on the EU non-cooperative jurisdictions list) do not need to comply with the economic substance requirements but will need to provide satisfactory evidence of their tax residency.

Legal Entities with Relevant Activity

The legislation imposes Economic Substance Requirements to BVI resident entities (companies and limited

partnerships with legal personality) carrying out one or more any of the following “relevant activities”:

- Banking business

- Insurance business

- Fund management business

- Headquarters business

- Shipping business

- Distribution and service centre business

- Finance and leasing business

- Intellectual property (IP) business

- Holding business

The mentioned relevant activities are defined in the Act. Entities that

do not carry out any of these relevant activities are out of the scope of the legislation and therefore will not be subject

to Economic Substance Requirements.

On the other hand, some distribution and service activities only become

relevant activity when purchases are made from foreign affiliated companies or when services are provided to foreign

affiliated companies. A legal entity which carries on more than one relevant activity shall comply with the Economic

Substance Requirements in respect of each activity. An investment fund is outside of scope of the Economic

Substance Requirements, unless it carries on relevant activities besides being an investment fund.

Any entity which carries out a relevant activity in the BVI but claims to fall outside the definitions of resident entity

must make a formal claim and provide evidence that the entity is resident for tax purposes outside the BVI and which

is not on the EU list of non-cooperative countries. In the case that such evidence is not made available the, entity will

be required to meet the Economic Substance Requirements.

Subject to below, in order to meet the ES Test a legal entity carrying on a relevant activity must:

- conduct core income generating activities (“CIGA“) in the BVI;

- be directed and managed in the BVI; and

- taking into account the nature and scale of the relevant activity, have:

- an adequate number of suitably qualified employees physically present in the BVI;

- an adequate amount of expenditure incurred in the BVI; and

- appropriate physical offices for CIGA.

The Economic Substance Code does not seek to provide specific definitions of “adequate”, “suitable” or “appropriate” for the ES Test, instead noting that such terms should be given their ordinary English meaning and that the size of the particular business should be taken into consideration.

It is possible to outsource some or all of the BVI CIGA provided the legal entity is able to demonstrate that it is able to monitor and control the outsourced activities and that those activities are undertaken in the BVI.

Note that if a company is a “pure equity holding entity” which carries on no relevant activity other than holding equity participations in other entities and earning dividends and capital gains, the ES Law provides that it satisfies the ES Test if it

(i) complies with its statutory obligations under the BVI Business Companies Act; and

(ii) has in the British Virgin Islands adequate employees and premises for holding equity participations and, where it manages those equity participations, has in the British Virgin Islands adequate employees and premises for carrying out that management. A pure equity holding entity for these purposes means a legal entity that only holds equity participations in other entities and only earns dividends and capital gains.

On the other hand, high risk intellectual property (“IP”) businesses face more stringent requirements.

Enforcement and penalties

The ES Law contains penalties for failure to satisfy the ES Test, including:

- for the first determination of non-compliance, a minimum penalty of $5,000 and a maximum penalty of $20,000 ($50,000 for high risk IP entities) may be imposed by the ITA;

- for the second determination of non-compliance, a minimum penalty of $10,000 and a maximum penalty of $200,000 ($400,000 for high risk IP entities) may be imposed by the ITA;

- The ITA may also serve notice on the Financial Services Commission requiring that the legal entity be struck off the Register of Companies or Register of Limited Partnerships as applicable.

For the ES Act and Code on economic substance requirements please find following hyperlinks:

- Economic Substance Act 2018: https://eservices.gov.vg/gazette/content/recent-gazettes

- Economic Substance Code: https://bvifinance.vg/News-Resources/ArticleID/3017/Draft-Economic-Substance-Code

BVI Secrecy No More

The BVI Government has passed new legislation that requires Registered Agents for BVI entities to make certain information on the beneficial owners of all BVI companies and limited partnerships accessible by a secure Government search system. The Beneficial Ownership Secure Search System Act, 2017 (the “Act”), which was further amended on 16 June 2017, enables the creation of a new Beneficial Ownership Secure Search System (“BOSS system”). The new law is in addition to the BVI’s existing AML legislation, which already requires Registered Agents to collect and maintain beneficial ownership information for the entities to which they provide services.

The Act, which enters into force on 30 June 2017, was drafted to implement the terms of the Exchange of Notes which the governments of the BVI and the United Kingdom entered into on 8 April 2016. It provides the legal framework for recording accurate beneficial ownership information and the disclosure of that information to law enforcement authorities in jurisdictions with which the BVI has entered into bilateral agreements similar to the UK Exchange of Notes.

At the moment, only UK authorities can request the BVI authorities to provide beneficial ownership information that will be accessible through the BOSS system. The information accessible through BOSS will be the name, residential address, date of birth and nationality of each beneficial owner of a BVI company.

Key Features of the BOSS system

The BOSS system, developed by BDO, is set up as a decentralised data repository. This means that each Registered Agent maintains its own isolated, secure database which is encrypted with a unique, private key. A grid of network security technologies has been developed to encrypt the data and to block cyber-attacks while beneficial owner data is being uploaded to the BOSS system and while it is at rest in the Registered Agent’s database. The infrastructure of the system has been set up in a secure, stable G7 jurisdiction trusted by and independent of the BVI and the UK.

The BOSS system allows a search to be conducted across all of the separate Registered Agent beneficial ownership information databases. The searches cannot be traced and are invisible to Registered Agents.

Only designated persons who have passed security vetting tests and who are considered to be fit and proper will have access to the BOSS system to run a search. At this time, searches will only be conducted upon receipt of a bona fide search request from the UK Financial Intelligence Unit of the National Crime Agency and the request has been vetted and certified as proper, lawful and in compliance with the Exchange of Notes.

Fines and Penalties

Significant penalties and fines can be levied against both companies and Registered Agents which fail to comply with their respective obligations under the Act or which intentionally provide false information. A designated person who fails to treat search requests as confidential or who otherwise acts contrary to the search protocols established under the Act may also be liable to a substantial fine and/or a term of imprisonment.

Key Provisions of the Act

Application

The Act applies to all BVI business companies, except those companies that were struck off the Register of Companies before 1 January 2016 and which have not been subsequently restored.

Prescribed Beneficial Owner Information

The prescribed information to be collected for the beneficial owner of a company is: (i) name; (ii) residential address (iii) date of birth and (iv) nationality. (In cases where the beneficial owner is a company – see ‘Definition of a Beneficial Owner’ below – the prescribed information is: (i) name/alternative names; (ii) incorporation number or equivalent; (iii) date of incorporation; (iv) status (e.g. active/dissolved); and (v) registered address.)

Obligations of Corporate and Legal Entities

Each company must identify and inform its Registered Agent of its beneficial owners within 15 days. Any changes to the prescribed beneficial ownership information must be communicated to the registered agent within 15 days of the change.

Registered Agent Obligations

Registered Agents must create a database which is accessible to the BOSS system and upload to it beneficial ownership information for each of the companies under their administration by 30 June 2017. Registered Agents must also upload any changes to the beneficial ownership information communicated to them by a company within 15 days of receiving such notification. The information kept on the Registered Agent’s database will be kept confidential and will be accessible only by the Registered Agent or a specially designated person from a BVI law enforcement agency.

Definition of Beneficial Owner

The beneficial owner of a company (other than a company with securities listed on a stock exchange) is the natural person who owns or controls 25% or more of the shares or voting rights in a company or who exercises control over its management. (It should be noted that a company incorporated prior to 22 January 2009 may, in some cases, have a beneficial owner which is a corporate legal entity.)

In instances where a legal arrangement such as a partnership or trust is the beneficial owner, the beneficial owner is the natural person who controls the partnership or the trust (e.g. the general/managing partner of a partnership or the trustee of a trust) or the natural person by whom the legal arrangement was made (e.g. the settlor of a trust).

Where a company is in insolvent liquidation, the beneficial owner is the natural person who has been appointed as liquidator and where the beneficial owner is deceased and was a shareholder in the company, the personal representative or executor of that shareholder’s estate is considered the beneficial owner for the purposes of the Act.

Exempt Persons

The Act provides for a number of exempt persons for which companies and Registered Agents do not have to collect the prescribed beneficial owner information. These include: (i) a company which is recognised, registered or approved as a mutual fund under the BVI Securities and Investment Business Act, 2010; (ii) a company whose shares are listed on a recognised stock exchange; (iii) a person licensed under BVI financial services legislation; (iv) the subsidiary of a mutual fund or a listed company or (v) a company exempted by regulations.

While the company does not have to provide the four pieces of prescribed beneficial owner information for exempt persons, it has to collect and provide the following prescribed particulars for the exempt person: (i) name/alternative names; (ii) incorporation number or equivalent; (iii) date of incorporation; (iv) status (e.g. active/dissolved); and (v) registered address. The company also needs to provide the reasons why the exempt person is designated as such.

Registrable Legal Entity

A registrable legal entity is a legal entity which would be considered a beneficial owner but for the fact that it is a corporate entity and to which one or more of the following factors apply: (i) it is an exempt person; (ii) it is a legal entity whose securities are listed on a recognised stock exchange; (iii) it is a licensee or a foreign regulated person; (iv) it is a sovereign state or a wholly owned subsidiary of a sovereign state.

For example, where the beneficial owner of a BVI company is a corporate entity which is owned by the government of a country or if the corporate beneficial owner is regulated in a foreign jurisdiction, the corporate beneficial owner can be recorded and the Registered Agent does not need to identify the natural person who owns 25% or more of the shares in the corporate beneficial owner.

The Registered Agent will need to record the same prescribed particulars for the corporate beneficial owner as it does for an exempt person, i.e. (i) name/alternative names; (ii) incorporation number or equivalent; (iii) date of incorporation; (iv) status (e.g. active/dissolved); and (v) registered address. The basis for the corporate beneficial owner’s designation as a registrable legal entity will also need to be recorded.

Entry into Force

The Act enters into force on 30 June 2017. By that time, Registered Agents in the BVI must have collected and uploaded the prescribed beneficial owner information onto their respective secure databases.

https://tridenttrust.com/knowledge/news-events/bvi-passes-legislation-to-create-new-private-government-search-system-on-beneficial-ownership-june-2017/