Name of country

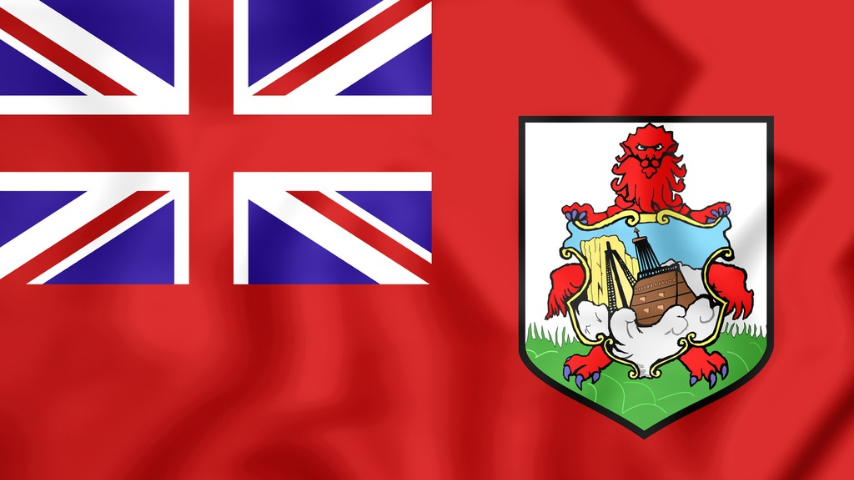

- BERMUDA

Region

- North America, group of islands in the North Atlantic Ocean, east of South Carolina (US)

Population

- 72,084 (July 2021 est.)

General Introduction

- Bermuda is a British Overseas Territory governed by British Common Law. It is a safe and secure country with excellent global connections worldwide. The island is conveniently located in the Caribbean and is only a two-hour flight from New York. The country benefits from a favorable tax regime, which attracts a large number of High Net Worth individuals to the island, including over 8,000 US ex-pats. Personal income tax is not levied on individuals in Bermuda. Instead, the Bermuda Government levies a Payroll Tax.

Wifi Speed

- Bermuda has jumped up the global rankings for broadband speeds and is now ahead of the United States, Britain, Canada, and all but one of the Caribbean nations.

- It has moved to 17th on Cable.co.uk’s annual list after a survey measured the island’s mean average download speed at 73.6 Mbps.

Electrical outlet

- On Bermuda, the power plugs and sockets are of type A and B. The standard voltage is 120 V and the standard frequency is 60 Hz

Per Capita GDP

Real GDP per capita

- $81,798 (2019 est.

- $81,421 (2018 est.)

- $81,835 (2017 est.)

Climate

- subtropical; mild, humid; gales, strong winds common in winter

Residence-by-Investment

- Bermuda is implementing a new investor visa program called the Economic Investment Certificate (“EIC”) on March 1, 2021, that will allow applicants, their spouses, and any dependant children to remain in Bermuda for five years.

Investment

A minimum investment of $2.5 million in one of the following categories is required to qualify for an Economic Investment Certificate.

- Residential or commercial real estate in Bermuda;

- An existing Bermuda-based business;

- The development and launch of a new Bermuda-based business;

- Bermuda Government bonds;

- Bermuda Registered charity in the areas of sports development, youth, seniors and health;

- The Bermuda Trust Fund or Sinking Fund; or

- Other social or useful venture that benefits Bermuda, Bermudians and things Bermudian as may be determined by the Minister responsible for Immigration.

Processing Time

- Between 6 to 7 months.

Key Benefits

- Those wanting to transfer their businesses and family to Bermuda should take advantage of the Economic Investment Certificate and Residential Certificate Policy. Unlike previous legislation, which concentrated on recruiting seniors who were subsequently prevented from working, the government is now allowing affluent working individuals to enjoy the benefits of Bermuda life.

Eligibility

To apply, you can be a new applicant, or have a specific Bermuda connection, or you can have one of the following (please attach copies of indicated items):

- an expiring or expired residential permission

- a short-term work permit

- an Entry/re-entry document or written permission from the Minister to reside in Bermuda.

Requirements

You must supply the following information:

- Completed Application for Residence Form

- Police certificate

- Medical clearance (required for first-time residents)

- Employment references

- Character references

- Qualifications

- Required fee(s)

- Passport size photos

- Proof of Citizenship (passport)

- Proof of Multi-entry Visa/Permanent Resident Card issued by USA, Canada or UK

- Marriage certificate (if applicable)

- Partner information (if applicable)

- Birth certificate

- Resume for applicant

- Specific Bermuda connection (if applicable)

- Financial support information (if applicant is seeking permission to reside including a sponsored dependent)

Natural Resources

- limestone, pleasant climate fostering tourism

Ethnic Groups

- African descent 52%, White 31%, mixed 9%, Asian 4, other 4% (2010 est.)

Languages

- English (official), Portuguese

Religion

- Protestant 46.2% (includes Anglican 15.8%, African Methodist Episcopal 8.6%, Seventh Day Adventist 6.7, Pentecostal 3.5%, Methodist 2.7%, Presbyterian 2.0%, Church of God 1.6%, Baptist 1.2%, Salvation Army 1.1%, Brethren 1.0%, other Protestant 2.0%), Roman Catholic 14.5%, Jehovah’s Witness 1.3%, other Christian 9.1%, Muslim 1%, other 3.9%, none 17.8%, unspecified 6.2% (2010 est.)

Median Age

- total: 43.6 years

- male: 41.6 years

- female: 45.7 years (2020 est.)

Urbanization

- urban population: 100% of total population (2021)

- rate of urbanization: -0.2% annual rate of change (2020-25 est.)

Physician density

- 0.00 doctors per 1,000 people.

Government type

- Overseas Territory of the UK with limited self-government; parliamentary democracy

Unemployment Rate

- 7% (2017 est.)

- 7% (2016 est.)

Taxes

Headline Personal Income Tax Rate (highest marginal tax rate) – 0%

Headline Corporate Income Tax Rate (excluding dividend taxes) – 0%

- Bermuda has no taxes on profits, income, dividends, or capital gains, no profit accumulation limit, and no dividend distribution requirement.

- Because remote workers are not employed in Bermuda, they are exempt from paying income taxes.

Trusts (Special Provisions) Act 1989

11A. (1) A trust may be created for a non-charitable purpose or purposes provided that the conditions set out in subsection (2) are satisfied; and in this Part such a trust is referred to as a “purpose trust”.

- The conditions are that the purpose or purposes are-

- sufficiently certain to allow the trust to be carried out,

- lawful, and

- not contrary to public policy.

- A purpose trust may only be created in

- The rule of law (known as the rule against excessive duration or the rule against perpetual trusts) which limits the time during which the capital of a trust may remain unexpendabley to the perpetuity period under the rule against perpetuities shall not apply to a purpose trust.

12B. (1) The Supreme Court shall make such order as it considers expedient for the enforcement of a purpose trust on the application of any of the following persons –

- any person appointed by or under the trust for the purposes of this subsection;

- the settlor, unless the trust instrument provides otherwise;

- a trustee of the trust;

- any other person whom the court considers has sufficient interest in the enforcement of the trust; and where the Attorney-General satisfies the court that there is no such person who is able and willing to make an application under this subsection, the Attorney-General may make an application for enforcement of the trust.

- On an application in relation to a purpose trust by any of the following persons-

- any person appointed by or under the trust for the purposes of this subsection;

- the settlor, unless the trust instrument provides otherwise;

- a trustee of the trust, the court may if it thinks fit approve a scheme to vary any of the purposes of the trust, or to enlarge or otherwise vary any of the powers of the trustees of the

- Where any costs are incurred in connection with any application under this section, the Supreme Court may make such an order as it considers just as to payment of those costs (including payment out of the property of the trust).

12C. Nothing in this Part affects the creation, termination or validity of any kind of created under any other law, but, save as aforesaid, purpose trusts which do not comply with section 12A are invalid.

12D. No interest in land in Bermuda shall be held, directly or indirectly, in a purpose trust.

Bermuda was the .first of· the more established offshore jurisdictions to enact thorough legislation validating the use of non-charitable purpose trust. ·The concept it was introduced by the Trusts (Special Provisions) Act 1989 and was conceived primarily to respond to the need for a trust to be able to fulfill a useful, role in a commercially setting – that of the role of company, by those invited to establish a family office and by clients from jurisdictions where they are not very familiar with the trust concept. In some cases, where risky assets are involved, an institutional trust company may not be willing to act as a trustee, and a private trust company then serves as a purulent option. Through the use of a purpose trust, the settlor or grantor is separated from the ownership of’ the company which acts as the trustee of· a family trust. In addition, in contrast to an individual trustee, a corporate trustee does not require a new trustee to be appointed upon the death or resignation of one of its directors. Shares in these private trust companies must be owned by someone. This could be a settler or beneficiary, or another company. However, in any case the sponsor or promoter of the private trust company does not want to be connected with the ownership and set up of the private trust company , perhaps for onshore tax or control reasons. It is common therefore to see a private trust company “orphaned”, by having the shares orphaned by a separate vehicle such as a purpose trust, normally in the jurisdiction in which the private trust company is incorporated. There are no issues of transfer of ownership on death, probate, divorce or incapacity. An institutional trust company will usually act as trustee of a purpose trust set up in this way.

A purpose trust is also an effective vehicle to close assets off the balance sheet of a company, because it does not typically have beneficiaries. Purpose trusts have a breadth of uses and, in Bermuda are frequently used for security (or collateral trusts), sinking funds trusts ( also known as company reserve), for the divestment of debt obligations, for private investment funds as directors’ run-off insurance trusts, voting trusts, partnership or joint venture buy out trusts, philanthropy, and finally, research and development trusts.

Advantages of a Bermuda purpose trust

A Bermuda purpose trust has the following advantages:

- Flexible vehicle – There is a lack of rigid requirements for the creation and operation of trusts when compared to

- Trustee duties -A trustee in a purpose trust need not be concerned with duties owed to beneficiaries with converting claims and

- Confidentiality – The terms of· the trust, its settlor and the purposes are confidential.

- Registration – Trusts are not required to be registered except for certain trusts which are themselves established to fulfill a specific statutory obligation.

- Set up–In Bermuda, trusts are relatively easy to set-up, requiring fewer formalities than the incorporation of a company.

- Protection – Assets are dedicated to a specific purpose and are “ring-fenced” from insolvency risks, thereby creating a protected fund so that “bankruptcy remoteness” can be achieved.

- Balance sheet – The transaction may be effective “off balance sheet” or as an “orphan” structure in relation to its originator.

- Voting – Purpose trusts can facilitate arrangements to separate voting from economic

- Ownership – purpose trusts can provide an ownership vehicle for private trust companies , special purpose vehicles and special purpose insure.

- Purpose trusts can be used to hold a.fund as security for parties’ obligations in commercial transactions.

Bermuda, in practice

Bermuda is a British Overseas Territory that has been at the forefront of the trusts, insurance and funds industries for the Last 50 years. It is a premier jurisdiction to develop trust structures, including charitable and non-charitable purpose trusts. Bermuda has a favorable and well respected legal and regulatory regime and a robust professional services industry. Appeals from Bermuda Supreme Court are heard by the Privy Council in the United Kingdom.

The Tax Position i11 Bermuda

In Bermuda there are no taxes on profits, income or dividends, nor is there any capital gains on trusts. There is nominal stamp duty on certain trust documents where the trust.fund holds non-Bermuda property. There are a number of extensions available from standard duty for trusts of non Bermuda property executed by a local trustee, pension trusts and, under the Stamp Duties (International Business Relief Act) 1990, trusts to which an international business is property a party. An exempted party would be properly party when, for example, it acts as trustee or settles non Bermuda assets into a trust. The position is different where the settlor is Bermudian national or where the assets are Bermuda dollar assets.