In this article I will talk about how the US treats stock options then I will talk about Singapore. The contradiction between the 2 jurisdictions would be clear. Many US exposed persons working in Singapore encounter this problem. The key issue is the deemed exercise rule. There is not much an employee can do about this rule. The most that can be done is defer the paying of the tax for some years, but the Singapore employer assumes the risk (more about US expat tax Singapore in this guide) and the employee is liable for interest.

USA

Under US law, if you receive an option to buy stock as

payment for your services, you may have income when you receive the option,

when you exercise the option, or when you dispose of the option or stock

received when you exercise the option. There are two types of stock options:

- · Options granted under an employee stock purchase

plan or an incentive stock option (ISO) plan are statutory stock options. - · Stock options that are granted neither under an

employee stock purchase plan nor an ISO plan are nonstatutory stock

options.

Statutory Stock Options

If your employer grants you a statutory stock option, you

generally don’t include any amount in your gross income when you receive or

exercise the option. However, you may be

subject to alternative minimum tax in the year you exercise an ISO. You have taxable income or deductible loss

when you sell the stock you bought by exercising the option. You generally treat this amount as a capital

gain or loss. However, if you don’t meet special holding period requirements,

you’ll have to treat income from the sale as ordinary income. Add these amounts, which are treated as wages,

to the basis of the stock in determining the gain or loss on the stock’s

disposition. Refer to Publication 525 for specific details on the

type of stock option, as well as rules for when income is reported and how

income is reported for income tax purposes.

- · Incentive Stock Option – After exercising

an ISO, you should receive from your employer a Form

3921.pdf, Exercise of an Incentive Stock Option Under Section 422(b).

This form will report important dates and values needed to determine the

correct amount of capital and ordinary income (if applicable) to be reported on

your return. - · Employee Stock Purchase Plan – After your

first transfer or sale of stock acquired by exercising an option granted under

an employee stock purchase plan, you should receive from your employer a Form

3922.pdf, Transfer of Stock Acquired Through an Employee Stock

Purchase Plan under Section 423(c). This form will report important dates and

values needed to determine the correct amount of capital and ordinary income to

be reported on your return.

Nonstatutory Stock Options

If your employer grants you a nonstatutory stock option, the

amount of income to include and the time to include it depends on whether the

fair market value of the option can be readily determined.

- · Readily Determined Fair Market Value – If

an option is actively traded on an established market, you can readily

determine the fair market value of the option. Refer to Publication

525 for other circumstances under which you can readily determine the

fair market value of an option and the rules to determine when you should

report income for an option with a readily determinable fair market value. - · Not Readily Determined Fair Market Value – Most

nonstatutory options don’t have a readily determinable fair market value. For

nonstatutory options without a readily determinable fair market value, there’s

no taxable event when the option is granted but you must include in income the

fair market value of the stock received on exercise, less the amount paid, when

you exercise the option. You have taxable income or deductible loss when you

sell the stock you received by exercising the option. You generally treat this

amount as a capital gain or loss. For specific information and reporting

requirements, refer to Publication 525.

—————–

Singapore

For shares granted on or after 1 Jan 2003 under any ESOP (employee

share options) or ESOW (other Employee Share Ownership) plans, the gain derived

from the plans is taxable if the individual is granted the options or shares

while he is exercising employment in Singapore.

Where there is a moratorium on shares granted under any ESOP

or ESOW plans, the taxable options or shares derived by individual will only

constitute gains accruing to him on the date the moratorium is lifted. Generally, the amount of taxable gains or

profits is the difference between the open market price of the shares at the

time of exercising/accruing/vesting of the ESOP/ESOW and the amount paid by the

individual for such shares. As a tax

deferral scheme, QEEBR (Qualified Employee Equity-based Remuneration Scheme) was

introduced in 1999 to ease the cash flow problems faced by some employees who

do not sell their shares after exercising the option. Under this scheme, the payment of tax arising

from stock option gains can be deferred for up to 5 years with interest charge.

What concerns most foreigners working in Singapore is the deemed

exercise rule. It applies when a

foreigner ceases employment or Singapore Permanent Residents (“SPRs”) leave

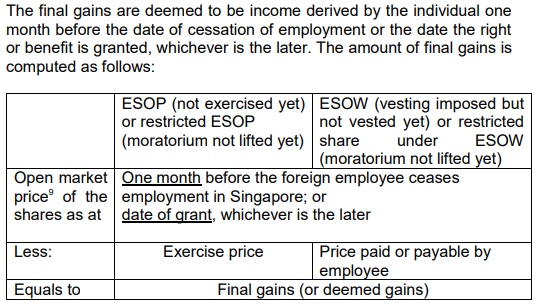

Singapore permanently. Under the rule, the final gains from unexercised ESOPs,

or other relevant ESOPs or ESOWs are deemed to be income derived by the

individual one month before the date of cessation of employment or the date the

right or benefit is granted, whichever is the later.

As an alternative to the “deemed exercise” rule and subject

to certain conditions, employers are allowed to track when the “income

realization event” of the foreign employee occurs. The “income realization event” refers to the

following:-

- · when the foreign employee exercises options that

were unexercised; or - · when the shares acquired under any ESOP plan are

no longer subject to any restriction; or - · when the shares under any ESOW plan that were

unvested or restricted at the time he ceases employment in Singapore become

vested or are no longer subject to any restriction.

In this scenario, the employer takes responsibility for

collecting and remitting the taxes due. For the employer to do this, they must meet several criteria including

being Singapore incorporated, have adequate systems for tracking, meet

capitalization requirements, and have an excellent tax paying record for the

past 3 years.