It is always helpful to get professional advice before proceeding

with any investment. Tax advice is especially

critical as taxes can make an otherwise attractive investment unattractive.

Ways in which an adviser can help –

- Advising on appropriate structures to avoid or minimise UK

income tax, stamp duty land tax, VAT and inheritance tax - Introducing appropriate UK advisers including legal advisers

and letting management agents - Establishing non-resident status with HM Revenue &

Customs (HMRC) - Arranging for income to be received gross

- Identifying and maximising tax deductible expenditures and

capital allowances - Submitting rental income returns to the HMRC and advising taxation payments due

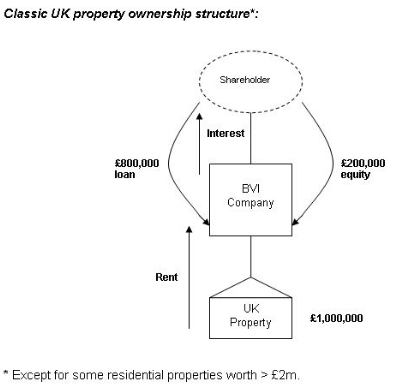

Typical structure

Taxable elements need to be held separately from non-taxable

elements. Typically, a non-UK company

holds the property and another (typically, a UK company) to carry out the

trading activity/development project. There

is flexibility to superimpose whatever ownership structure is desired above the

‘special purpose vehicle’ that owns the property.

A UK resident landlord includes the property income on the

annual tax return he makes to HMRC. Tax for a tax year (which in the UK runs

from 6 April to 5 April) is sometimes paid in advance of filing the tax return.

Payment is often made in two instalments on 31 January in the year and 31 July

following the end of the year with sometimes a final payment on the following

31 January when the tax return is filed.

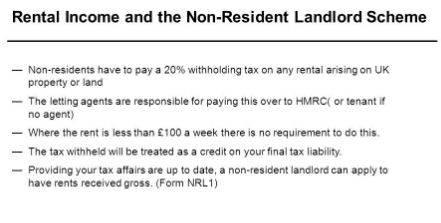

The treatment described above as applying to UK residents

will normally be offered to any non-UK resident landlord who applies for it. However, if this treatment is not applied for (or if HMRC reject the

application) a much harsher collection regime is imposed. Any managing agent

must deduct and pay to the Revenue tax (at 20%) from rents net of any expenses

that he pays on behalf of the landlord; a tenant who pays direct to the

landlord must deduct tax at basic rate from all rent payments (unless the rent

is less than £100 per week). Where tax deducted at source exceeds the true tax

liability for the year it is possible to obtain repayment from the Inland

Revenue by filing a tax return.

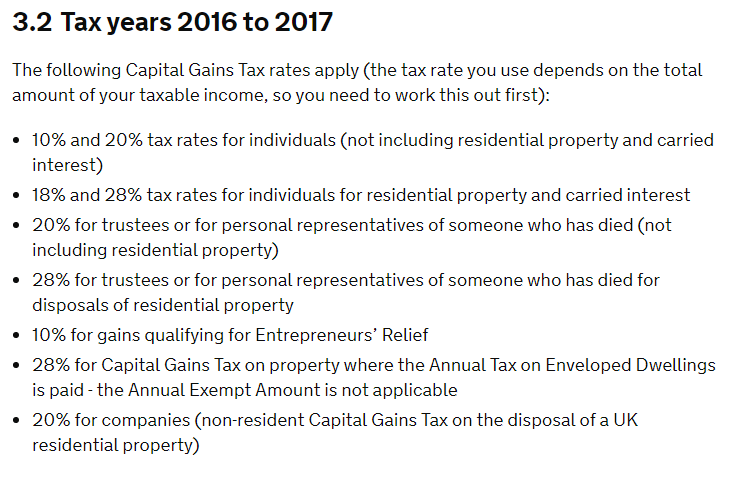

Capital gains

In principle, capital gains on commercial property made by a

non-UK investor are not subject to tax. Therefore a non-UK entity, typically a

company, should be used to hold the property. In order to benefit from this

exemption, two key conditions need to be satisfied:

- The investor must not be engaged in ‘trading’ activity in

relation to the property in question. Material redevelopment of the property or

an intention at the time of purchase to sell the property within the first few

years after acquisition would generally constitute trading. New rules mean that the profits of any

development activity carried on in the UK are subject to tax in the UK.

- ‘Management and control’ of the non-UK entity must take

place outside the UK. Therefore, while UK agents may take day-to-day decisions

in the UK, any more strategic decisions must be taken outside the UK.

In general the UK only taxes individuals who are UK tax

resident to capital gains tax. The main

exception is on residential property. The

UK tax loophole which allowed overseas investors and British

Expats to avoid Capital Gains Tax (CGT) on the sale of

residential property is now largely closed. The

legislation allows three ways in which such gains can be taxed however in most

cases tax will be charged based on the proceeds less the value at 5 April 2015

(or if the property was purchased after 5 April 2015 the cost at purchase).

Since the new rules came into force in April 2015 as a

non-resident, when you sell a UK residential property you must tell the HMRC,

even if you have no capital gains tax to declare. This also applies if you are

selling, or have sold, your main residence.

Failure to correctly make a capital gains tax declaration to

the HMRC within 30 days after conveyancing (transferring ownership of) your

property is likely to result in a penalty – even if there is no capital gains

tax to pay.

Non-resident companies have potentially been liable to UK

capital gains tax on the disposal of UK residential property since 1 April 2013

if the property was valued at more than £2 million. That threshold has now

dropped to £500,000 and covers most properties in the London area.

Disposals of commercial property by non-resident investors

remain exempt from UK capital gains tax.

A word of caution is needed though: the tax rules summarised

above assume that the investment in real estate is a genuine investment, made

in order to generate rental income and with a view to long-term capital growth.

If however property is acquired with the

sole or main object of realising a profit on disposal, with or without any

development of the property, any gain on disposal will normally be treated as

income rather than as capital gains. It will therefore be subject to UK

taxation as income and the beneficial treatment of capital gains referred to

above will not be available.

Ordinary Income

UK income tax is charged on income from letting property

situated in the UK regardless of the residence status of the landlord. This income is computed using ordinary

accounting principles.

For example:-

- Income and expenses can be taken into account on an accruals

or an arising basis. - Normal revenue expenses of earning income are tax

deductible, including repairs, maintenance, insurance, management fees etc. It

is important that detailed records, including invoices, are kept. - Interest on a loan taken to acquire the property is in

principle tax deductible though relief will be restricted to the basic rate of

tax on a transitional basis from 6 April 2017 and phased in over 4 years. - If the loan is taken from a connected party then relief will

be restricted to the amount of interest that would have been paid in the open

market. Even where capital is available it can often be tax efficient to borrow

to invest in UK property. - Capital expenditure (for example, on improvements to

property as distinct from repairs and maintenance) is not deductible from

rental income. It will instead be regarded as an additional cost to be taken

into account when calculating any gain arising on a disposal of the property

provided that it can be said to enhance the value of the property. - No tax relief is available for depreciation or amortisation

of the property itself. But in the case of commercial property, capital

allowances (which are effectively depreciation allowances at a low standardised

rate) are available for those elements of the property which meet the

description of “plant and machinery”. This can be a valuable relief and the

element attracting these allowances is normally negotiated (within statutory

limits) at the time of purchase. - All lettings carried on by a particular person are

amalgamated for tax purposes and treated as a single business; thus if some

properties are loss-making and others profitable, the set-off for tax purposes

is made automatically. - Non-UK-resident owners other than individuals (such as

companies or trustees) pay tax on the profits computed at a flat rate of 20%. Individuals

are liable at progressive rates rising from 20% to 45%, though many

non-resident individuals (broadly, citizens of any state in the European

Economic Area and certain Commonwealth countries) are entitled to claim

personal allowances which give exemption from tax for the first £11,000 or so

of profit. - The income may also be subject to tax in the property

owner’s home jurisdiction, although if there is a double Taxation Treaty with

the UK (which is likely – the UK ‘s Treaties are among the most comprehensive

in the world) the treaty will sometimes benefit the owner.

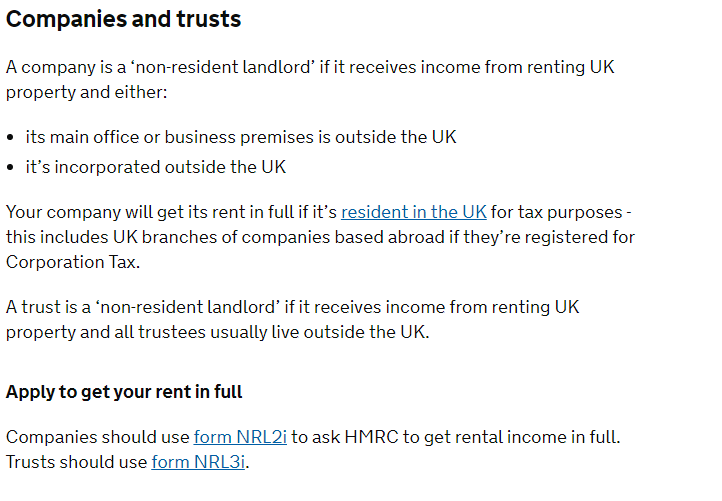

Income derived from the property by a non-UK resident

company will be subject to income tax at the basic rate of 20%. This tax is

subject to a ‘withholding’ regime which means that the tenant or other paying

entity must deduct the tax due and account for it directly to the tax

authority, HM Revenue & Customs (‘HMRC’). In most cases, the holding

company or other owning entity will register under HMRC’s ‘non-resident

landlord scheme’ which will allow it to receive income gross, deduct expenses,

calculate taxable profits, and submit a UK tax return in the usual way.

Gearing / Borrowing to Invest

Currently (subject to the commerciality test) all borrowing

costs are deductible to reduce taxable profit, but changes targeted for April

2017 will limit the amount of deductible interest to 30% of the owner’s EBITDA

(broadly equivalent to income in the context of an SPV owning a

single property let on a ‘full repairing and insuring’ (or in US terms, ‘triple

net’) lease. This restriction is likely to apply equally to UK and non-UK

owners and will bring the UK into line with a number of other ‘competitor’

markets.

Capital allowances

It is not unusual for the seller’s ‘capital allowances’ to

be transferred, in whole or part, to the buyer. These are ‘writing down’

allowances against taxable profits in respect of historic capital investment in

plant and machinery. The allowances are at the rate of 18% a year, with an 8%

rate applying to ‘integral features’, and generally have effect on a ‘reducing

balance’ basis. Each year the allowance is applied to the balance of

expenditure after deduction of previous years’ allowances, for example the 18%

allowance is applied to 100% of the qualifying expenditure in the first year

but to only 82% of the expenditure in the following year and so on. This means

that around 75% of the expenditure is ‘written down’ over the first seven

years.

On the sale of a property, the seller may well wish to

retain any unused capital allowances. However, where the buyer would be able to

benefit from them more than the seller, it may make more commercial sense for

the seller to pass them to the buyer, generally for additional consideration.

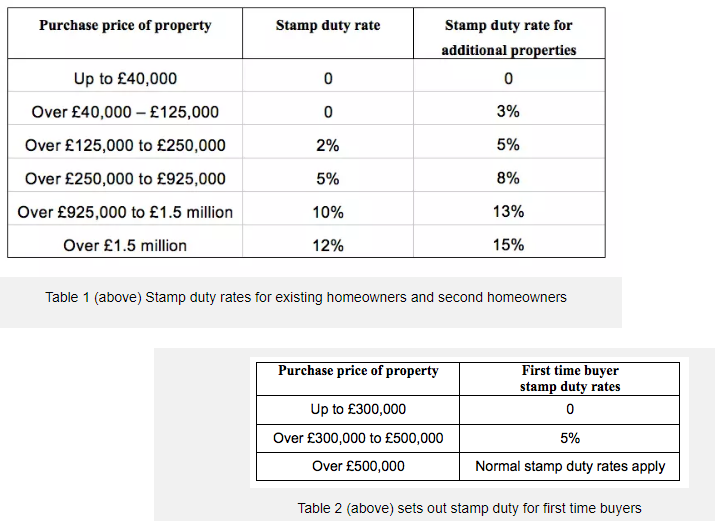

Stamp duty land tax (‘SDLT’)

It is payable by the buyer. The purchase price will include

any VAT, but fortunately this ‘tax on tax’ is rarely levied

SDLT will be payable within 30 days after ‘substantial

performance’ of the transaction, which is usually completion.

If a non-UK propco (as opposed to the real estate it owns)

is sold, no SDLT or stamp duty will be payable. If a UK propco is

sold, stamp duty at 0.5% will be payable.

Value added tax (‘VAT’)

Supplies of land and buildings, such as freehold sales,

leasing or renting, are normally exempt from VAT. This means that no VAT is

payable, but the person making the supply cannot normally recover any of the

VAT incurred on their own expenses.

However, you can opt to tax land. For the purposes of VAT,

the term ‘land’ includes any buildings or structures permanently affixed to it.

You don’t need to own the land in order to opt to tax. Once you have opted to

tax all the supplies you make of your interest in the land or buildings will

normally be standard rated, and you will normally be able to recover any VAT

you incur in making those supplies.

VAT at 20% may be charged on the purchase price of

commercial or mixed-use properties. This will be the case with new buildings

and those where the seller has ‘opted to tax’. In cases where the sale is

subject to VAT, there will be little practical alternative other than to

‘opt to tax’. That will often have the effect of making the sale itself VAT-free

(and consequently mitigating the SDLT payable).

Where there is no immediate need to opt to tax, you should

consider the best strategy for the property as a whole, taking into account

future expenditure plans and the likely tenant-mix profile as some tenants will

not be able to recover the VAT paid on rent.

Many of the costs incurred by investors in UK real estate

will be liable to UK VAT at 20%, including legal, architects and survey fees,

estate agents charges and other professional costs. Since the letting of

residential accommodation is (in almost all cases) not a “taxable activity” for

VAT purposes, the VAT suffered on those costs is not generally recoverable.

Furthermore, VAT remains chargeable on services relating to UK land regardless

of the place in which the recipient “belongs” for VAT purposes; the zero-rating

available in respect of certain international services is not available where

the services relate directly to UK land. Some associated services less directly

connected with land (for example, accountancy fees) will usually be zero-rated

where supplied to a non-resident.

Some commercial property is within the scope of VAT and it

is normally possible to elect (on a property-by-property basis) to bring

commercial (but not residential) properties within the VAT regime. We can

advise on whether such an election is necessary, possible or desirable and to

assist with relevant registrations. Residential and commercial

developments and conversions may be affected by special rules on which we can

also advise.

IHT: inheritance tax

Inheritance tax (which is normally payable only by

individuals) combines some of the features of a gift tax, death duty and wealth

tax. For most non-UK resident individual property investors, who have had no

prior connection with the UK, only assets within the UK will be within its

scope.

Although, with a 40% rate on death and a 20% rate on lifetime transfers,

inheritance tax is at first sight a significant impost. There are many reliefs

and exemptions which, properly used, can greatly reduce its impact. In

particular:-

- the first £325,000 of transfers (on a seven-year rolling

basis) are free of tax - many transfers are “potentially exempt ” and create a charge

to tax only if death follows within seven years of the date of the transfer - the use of trusts may often effect substantial savings

From 6 April 2017, UK residential

property is liable to UK inheritance tax regardless of how it is held.

High-value residential properties owned by companies

New rules were introduced in 2012 affecting the tax paid in

relation to residential properties that are purchased and owned by companies,

for properties with a value in excess of £2,000,000. The threshold was reduced

to £1 million at 1 April 2015 and £500,000 at 1 April 2016. Where these rules

apply, they can create an SDLT rate of up to 15% on purchase; an Annual Tax

Charge of up to £218,200; and an uplifted CGT charge on sale.