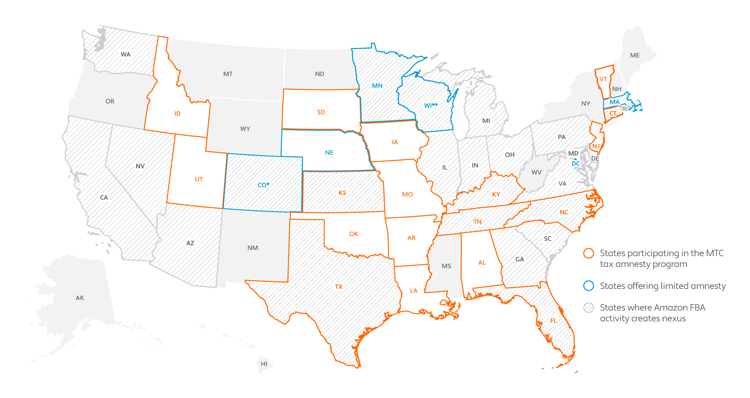

Bye Bye John…but what about amnesty programs?

As expected, IRS Commissioner John Andrew Koskinen will step down in November. It is expected that this may have implications for 2 key offshore voluntary compliance programs that we cover for many of our international clients. These are – 1. The streamlined initiative and 2. The OVDP http://www.derrenjoseph.com/2015/02/streamlined-foreign-offshore-procedures.html Note: The above reference link was live on […]

Bye Bye John…but what about amnesty programs? Read More »