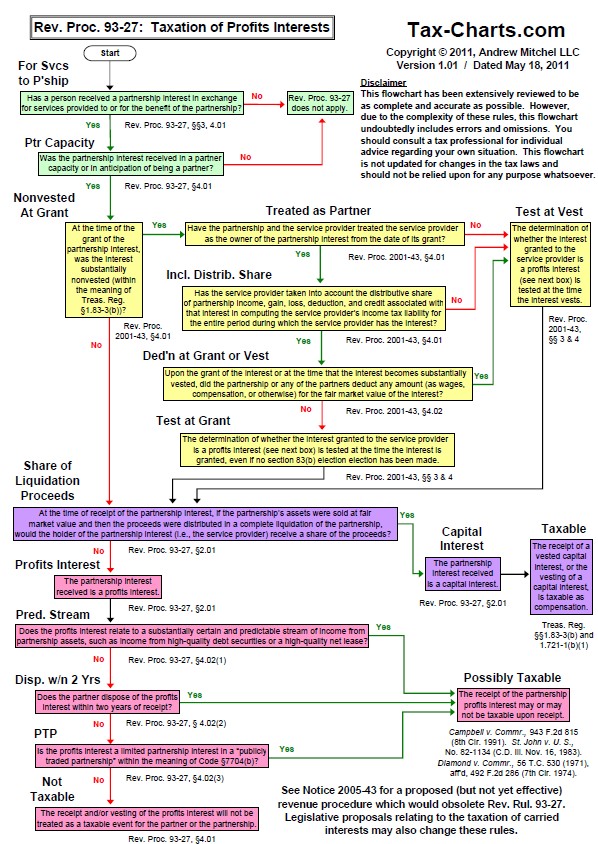

Here’s a chart found at tax-charts.com in November 2020 and dated May 2011 which I found incredibly helpful. The scenario is employee shares are issued with the intention that they be treated as “profits interests” within the meaning of Rev. Procs. 93-27 and 2001-43, which would be taxable as capital gains upon disposition rather than ordinary income.

Capital gain tax treatment is subject to the

completion and submission of a Section 83(b) election package within 30

days of the grant date and is discussed here –

Anyway, here’s the chart