For background, please read –

US – https://www.mooresrowland.tax/2019/10/navigating-post-wayfair-world.html

EU – https://www.mooresrowland.tax/2019/10/distance-selling-in-eu.html

Digital Nomads in Asia – https://www.mooresrowland.tax/2018/04/tax-responsibilities-of-digital-nomads.html

US Digital Nomads – https://www.mooresrowland.tax/2018/03/non-us-digital-nomads-working-for.html

Taxing remote businesses

For a government to levy corporate tax on a foreign firm, tax rules require a “nexus” or link between the taxpayer and the taxing jurisdiction, typically in the form of physical presence such as offices or workers. In our digital world, firms can interact with users and create value in a country without needing to physically set up there. More than 130 countries are discussing new rules, under the OECD’s Inclusive Framework, to change the nexus requirement so it is not dependent on physical presence.

The rules will determine how to allocate some taxable profits to (and among) market jurisdictions where users reside. The OECD Secretariat released its proposal on 9 October, to help countries reach consensus by the end of 2020.

Fearing foot-dragging by others, some countries have felt compelled to act unilaterally in the meantime. France, in July 2019, imposed a 3% digital services tax on revenues derived from digital activities where French users play an active role in creating value. India changed its laws so that, as of April 2019, remote business are liable for corporate tax if they have a “significant economic presence” in the country.

Global minimum tax

Another concern that OECD Inclusive Framework countries are tackling is the possibility for businesses to shift profits to low-tax jurisdictions. Tax competition among governments – lowering corporate tax rates to attract investment – also contributes to this problem. New rules could give countries the right to “tax back” where another country has taxed income below an agreed minimum rate. Similar steps are taken in the US’s 2017 Tax Cuts and Jobs Act. These rules are not limited to digital businesses but are seen as particularly relevant to profits related to intangible assets, which are important in a digitalized economy. Countries, typically smaller ones, that rely on low corporate tax rates to attract businesses will be difficult to convince, and much will depend on the minimum rate that’s settled on.

The rules about digital tax worldwide are constantly changing as governments want to charge tax based on the location of the purchaser. Always speak with your tax professional before proceeding

Albania

Albania introduced their VAT rules for digital business on 1st January 2015. The standard VAT in Albania is 20% and there is no registration threshold. It means that non-resident businesses, who make a single sale to Albanians consumers, have to collect and register for VAT in Albania by a local tax agent for it.

Like other countries, there are no registration obligations for supplies made to VAT-registered customers in Albania so they have to self-charge VAT (i.e. reverse-charge mechanism), however, Albania has not introduced any online tool to automatically verify the VAT status of the customer online in real-time so it is very difficult for foreign companies to confirm that their customers are B2B or B2C.

Angola

Angola has a 14% VAT for all sales. There is no registration threshold for foreign providers of digital services, so you must register for VAT as soon as you have a single Angolian customer. To register for Angola VAT as a non-resident digital service provider, you must appoint a local tax representative. The country will eventually offer a simplified registration system on its website.

For B2B sales, there’s the option of using the reverse-charge mechanism.

Australia

Australia has a 10% GST on sales of low value goods to its consumers by non-resident e-Commerce companies. This includes:

- digital products such as streaming or downloading of movies, music, apps, games and e-books

- services such as architectural or legal services.

If you meet the registration turnover threshold of A$75,000 and make these supplies, you will be required to register for GST.Anyway, for further information have a look at the Australian Taxation Office (ATO) site.

Bahrain

Bahrain is a member of the Gulf Cooperation Council (GCC) and has implemented the group’s policy on digital VAT for foreign sellers. The VAT rate for digital products is 5% with no registration threshold. Businesses selling B2C must register for VAT within 30 days of their first taxable sale in Bahrain. Businesses selling only B2B do not have to register, though, since Bahrain buyers will handle VAT themselves through the reverse-charge mechanism.

Read more on the National Bureau for Taxation (NBT), Bahrain’s tax agency.

Bangladesh

Bangladesh has a 15% VAT on digital sales. The VAT registration threshold is BDT 30M, including for foreign suppliers. Foreign suppliers must select a local tax representative and get approval from the Bangaladeshi tax commissioner. (Search for form Mushok 3.4.) The reverse-charge method is available for B2B transactions.

For further information, head to the National Board of Revenue of Bangladesh

Belarus

Belarus levies 20% VAT on digital goods and services sold to consumers in the country.

There’s no sales threshold, so every foreign business is expected to register for VAT, then collect and remit taxes according to the local guidelines. Business owners can register for VAT themselves, or elect to hire a local tax agent. Some of the registration materials must be translated into Russian, so hiring a tax representative could be helpful!

For more information, check out the Belarus Ministry of Taxes and Duties website.

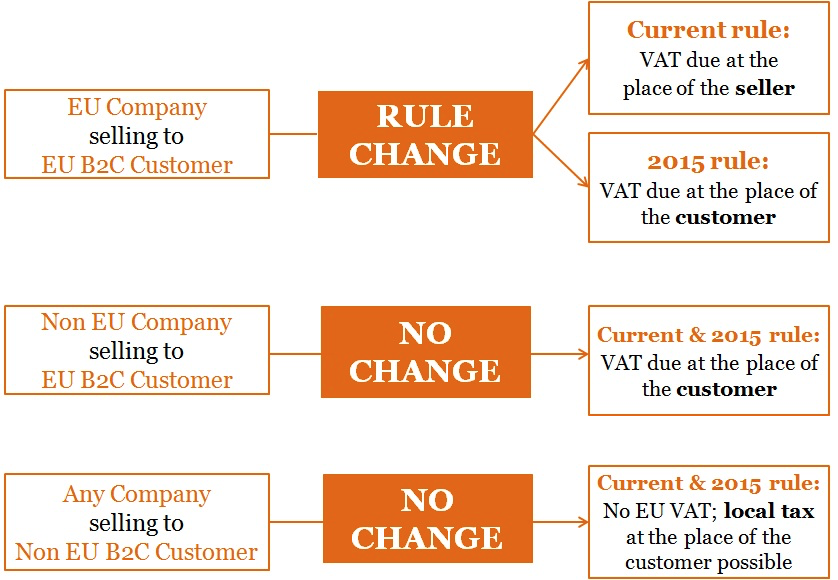

European Union

- Digital businesses who sell to European consumers must apply, collect, and remit VAT against all customer invoices.

- If you sell to VAT-registered businesses, they are exempt under a reverse-charge scheme, but you must have their VAT registration details.

- There is no “EU” VAT rate. The rate you need to charge is the rate of the country in which your customer resides. This means you need to be set up to apply the correct VAT rate to the right country.

- If collecting and paying out VAT to each individual jurisdiction sounds like a headache, you can get set up with a MOSS (mini one-stop shop) to administer your VAT returns and distribute what you have collected.

More here. And more details on the EU down below so continue reading

Iceland

The Icelandic Government introduced the VAT rules for electronic suppliers on 1st November 2011.

Here’s what you need to know:

- The standard VAT rate of 22.5% applies to all sales related to electronic services except e-books, which are taxed at the reduced VAT of 11%.

- Foreign companies must register with the tax authorities via a local tax agent.

- The VAT registration threshold is 2.000.000 ISK in any twelve-month consecutive period and not a calendar year.

It means that those foreign companies, which sell digital services to consumers from Iceland and their sales exceed the threshold of 2.000.000 ISK, are required to register for VAT in Iceland. If these foreign companies sell to VAT-registered businesses, the registration is not required and can account for the VAT as part of the input tax.

Japan

The Japanese tax, known as “consumption tax”, was introduced and made pertinent to digital business owners on 1st October 2015. The annual threshold for this tax is JPY 10 million.

Here’s what you need to know:

- The consumption tax rate is 8%.

- It is to be charged on all B2C e-commerce transactions delivered by foreign businesses to Japanese consumers. (Japanese businesses were already paying this and the idea is to level the playing field).

- Foreign companies must register and designate a tax agent for themselves in Japan.

- B2B transactions apply a “reverse charge” mechanism like other countries, where the recipient deals with the tax, not the seller.

Like other countries, the definitions of which electronic products and services are included in JCT (Japan Consumption Tax) are fairly broad. Digital services such as ebooks and courses do count under this law. You can check out an English version of their policy changes here though.

India

India classifies all digital products under a different, and very long, name: Online Information Database Access and Retrieval services. (Or OIDAR.) All products are services are subject to an 18% GST, and there’s no threshold for tax registration. That means that if you’re selling to customers in India, you must register for Indian GST and charge 18% tax when necessary. When is it necessary? When you’re selling to an individual, or B2C. Otherwise, all B2B transactions are covered by the reverse, so long as the buyer provides a registered tax number.

New Zealand

New Zealand introduced new laws to tax digital transactions as of 1st October 2016.

The GST rate of 15% will apply to all sales of NZD $60,000 or more across a 12 month period. Businesses who reach this level will be required to register for GST. Digital sellers who provide their services to New Zealand-based consumers must also collect two non-conflicting pieces of evidence proving the customer location (for example billing address, IPN location, bank details or country code of phone number). This is very similar to EU requirements. There doesn’t appear to be any distinction made between B2B and B2C customers. Here’s what Revenue Minister Todd McClay had to say:

“GST should apply to all consumption that occurs in New Zealand. This is what makes our GST system fair, efficient and simple. To reduce compliance costs, offshore suppliers will not be required to return GST on supplies to New Zealand-registered businesses, nor will they be required to provide tax invoices.”

Norway

If you’re not already aware of Norwegian VAT requirements, you’re actually a few years behind! Norway is one of the original countries to introduce tax rules on the digital economy, with laws going into effect back in July 2011. VOES (or VAT on E-Services) is where you need to look to ensure you’re compliant with their rules.

The Norwegian VAT rate is 25%. For B2C transactions, businesses must register for Norwegian VAT if their annual sales in the country exceed the tax threshold of NOK 50,000.

With regard to B2B services, they operate a similar scheme to the EU, where VAT is accounted for by the purchaser under a reverse-charge mechanism.

Québec

Any digital service suppliers located outside of Québec (either elsewhere in Canada or abroad) will have to register, collect, and remit Québec Sales Tax (QST), if their annual sales exceed the CAD $30,000 threshold. The QST rate is 9.975%.

Read more on Revenue Québec, Quebec’s tax agency.

Russia

Russia introduced new laws to tax digital transactions as of 1st January 2017.

The VAT rate of 20% applies to all sales. There’s no registration threshold, and there is no reverse charge mechanism available. Therefore all foreign businesses that sell digital products to Russia-based consumers must collect VAT and report to Russian tax authorities. VAT returns will be monthly, and come due by the 25th of the month following the quarter end.

Sellers must also collect two non-conflicting pieces of evidence proving the customer location (for example billing address, IPN location, bank details or country code of phone number). This is very similar to EU requirements.

Saudi Arabia

Saudi Arabia is a member of the Gulf Cooperation Council (GCC) and has implemented the group’s policy on digital VAT from foreign sellers. The VAT rate for digital products is 5% with no registration threshold. Foreign businesses must register for VAT in Saudi Arabia.

Read more on the General Authority for Zakat and Tax (GAZT).

Serbia

From 1st April 2017, Serbia is to require non-resident providers of electronic services to consumers to VAT register and charge local VAT. Some factors that must be considered:

- The VAT rate is 20%.

- Under the new VAT rules in Serbia, digital businesses are required to register for VAT, via a tax agent.

- Just like the EU, there is no registration threshold. This means that as soon as digital businesses make a digital sale to a Serbian consumer, they have to apply taxes and to settle VAT with the Serbian tax authority.

- If a foreign entity does not register for VAT; the fine for legal entity is up to 2,000,000 dinars and the fine for an individual is up to 150,000 dinars.

As a precondition for VAT registration, the foreign business should:

- Possess a Serbian Tax Identification Number (TIN).

- Determine the bank account that will be used for VAT purposes.

With respect to the bank account, the foreign business can:

- Open a non-resident bank account with a Serbian bank; or

- Use a bank account of the VAT proxy.

Note that it is not possible to pay Serbian tax liabilities from abroad. Tax Administration of Republic of Serbia site.

South Africa

South Africa introduced their VAT rules for electronic suppliers on 1st July 2014. They do have a lower-limit however, below which VAT is not required to be charged or registered for. That is ZAR 1000,000.

Unlike other countries, South Africa does not make a distinction between B2C and B2B sales – all are subject to their 14% VAT charge. Pretty much any kind of digital service you can think of is in-scope for their electronic VAT rules. Check out the list below, taken from a Tax Insights article:

Electronic services

In the final regulation at the end of March 2014, electronic services are defined as:

- Educational services (educational services only qualify as e-services if supplied by a person that is not regulated by an educational authority in the foreign country)

- Games and games of chance

- Internet-based auction services

- The supply of e-books, audio visual content, still images and music

- Subscription services to any blog, journal, magazine, newspaper, games, internet-based auction services, periodical, publication, social networking service, webcast, webinar, website, web application and web series

Another point to note is that the South African VAT act is not limited to South African residents. Therefore, your digital business based out of any other country could well be on the hook for VAT there if you meet the thresholds.

South Korea

South Korea has one of the most technologically advanced and internet-savvy populations in the world, with nearly 90% of people owning a smartphone. It’s no surprise, then, that they were early adopts of cross-border digital sales taxes. Here are the key points:

- The VAT is the standard SK rate of 10%.

- Just like the EU, there is no registration threshold – this tax applies as soon as you make a sale from outside of South Korea to someone inside South Korea, no matter the value.

- To get started, register as a “Simplified Business Operator”. Then you can file your VAT returns via Hometax.

- You will pay your returns on a quarterly basis into a VAT bank account operated by Woori Bank (a.k.a. The Korean National Tax Service).

Switzerland

The Swiss Federal Tax Authority (FTA) introduced their VAT rules for the supply of services from non-resident companies to Swiss residents on 1st January 2010. The VAT is the standard Swiss rate of 7.7% and their threshold is CHF 100.000.

For more information, take a look at the Swiss Federal Tax Authority (FTA).

Taiwan

From 1st May 2017, Taiwan will levy 5% VAT on digital services provided to consumers by foreign business. The rules mean foreign businesses supplying digital services will have to register for VAT in Taiwan, file VAT returns, and pay VAT to the Taiwan Taxation Administration.

Some factors that must be considered:

- Non-resident providers must register with the tax authorities directly or via a local tax agent.

- Providers will not be required to produce invoices until 2019.

- The VAT registration threshold will be NTD480,000.

- Returns will be bi-monthly.

Anyway, for further information has a look to the Taiwan Taxation Administration site.

Turkey

Since 1 January 2018, Turkey requires foreign businesses, who provide digital goods inside the country, to pay attention to VAT laws. Turkey’s digital tax policies depend on whether the sale is to a private consumer or to a VAT-registered Turkish business. If selling to a VAT-registered business in Turkey, then the foreign business does not need to charge VAT. The buyer will handle all Turkish VAT through the reverse-charge mechanism.

If selling to Turkish consumers, then the foreign business must:

- Register for VAT in Turkey. There is no sales registration threshold. It’s possible to register directly as a business owner, online through MERSIS, the commercial registry.

- Charge 18% VAT on digital goods and services sold to Turkish consumers.

- File VAT returns every month. Filings are due on the 24th of the following month, and payments are due the 28th.

To learn more, visit the website of Turkey’s Revenue Administration.

United Arab Emirates

Like Saudi Arabia, the UAE (more about American tax Dubai here) has also adopted the GCC’s Unified VAT Agreement about digital taxes on foreign sellers. Here are the basics:

The VAT rate for digital products is 5% with no registration threshold. Foreign businesses must register for VAT. To do so, first create an e-Services account with the Federal Tax Agency, and then complete the VAT registration form. The UAE have also provided a full guide to VAT registration in English.

More on the E.U. Digital Services Tax (D.S.T.)

Beyong the VAT or sales taxes adapted or expanded to DSTs, there are special DSTs that are being phased in and focus on groups with higher gross sales.

Most EU Member States have been discussing some form of local measures which are in the public and political domain in all countries. Some countries have already implemented new rules, others are still drafting them. The introduction of the new legislation has also increased tensions at the global political level (e.g. between the USA and France).

There have been concrete recent developments in the tax systems of Austria, Belgium, Czech Republic, France, Hungary, Italy, Poland, Slovenia, Spain and the UK. Each these countries have either proposed, announced or implemented some form of digital services tax. The following analysis provides an overview of the measures that some key Member States are introducing.

UK

In July 2019 the UK Government published its Finance Bill 2019-20, which included draft legislation for a 2% Digital Services Tax (DST) on the revenues of search engines, social media platforms and online marketplaces (financial and payment services are exempt) irrespective of how they monetise their platforms.

It is intended that the DST will apply from April 2020. It is projected to raise £275m in its first year rising to £370m thereafter, making it a relatively small contribution to the UK Treasury’s overall tax revenue. It is nevertheless an important consideration for companies whose activities fall in scope. The parameters for how the DST will work in practice follow::

- Tax liabilities will be calculated at group level but charged to individual entities in the group whose revenues involving UK users contribute to the tax thresholds, in proportion to their contribution.

- The thresholds mean that the DST will only apply to groups with global revenues over £500m and UK revenues over £25m, which includes an allowance so that a group’s first £25m of revenues derived from UK users will not be subject to the DST.

- There are different criteria for what constitutes participation by a UK user depending on the activity in question:

- Online marketplace transactions will be considered to involve UK users if at least one of the parties is UK based, however the tax revenue charged will be reduced by 50% if the other user is located in a country with a similar tax to the DST.

- Advertising revenues will be considered to have derived from UK users when the advert is intended for UK audiences.

- A ‘safe harbour’ principle will be available for in-scope companies who operate at low profit margins or losses. This allows such entities to use an alternative basis of charge in calculating their liabilities. This will effectively lead to a lower DST liability (or no liability if they are loss making).

- DST will be deductible as an expense of business, provided it is incurred wholly and exclusively for the purposes of a trade. However it will not be creditable against any UK corporation tax liability. This may result in double taxation.

Like other Member States with their own tax initiatives the UK Government has committed itself to finding a solution at international level, yet the proposal itself does not include a specific ‘sunset clause’ that would automatically withdraw the legislation. Rather, the Government has given itself some flexibility by stating that it will dis-apply the DST ‘once an appropriate international solution is in place’ and carry out a review in 2025.

There are already factors which stand between the DST proposal and its coming into force. First, the UK will face international opposition: as noted below, the USA recently threatened France with retaliatory action if they moved forward with plans for a similar tax. . The USA is also putting pressure on the UK and the need to maintain close relations with the USA for trade purposes could leave the DST shelved. Second, domestic UK politics could come into play. Although the UK’s new Prime Minister Boris Johnson has previously supported a DST, uncertainty facing the UK economy over the UK’s withdrawal from the EU and a new Chancellor of the Exchequer may mean that the DST misses its April 2020 implementation date for political reasons.

ITALY

Italy has been grappling with the digital economy for some time, trying to agree rules for the taxation of revenues deriving from online transactions. In 2019 Parliament approved a provision in the Budget Law which introduced a DST. This DST never entered into force: legislators were waiting for a common consensus at OECD level, with the aim of avoiding unilateral measures.

However, due to the delay in finding a common global solution and needing additional revenue, the Italian government is following the French example (below) by approving an Italian DST. The DST will be effective from January 1st, 2020. There is no need for a specific Decree for implementation unlike the previous version of the rule.

The revenues of the DST are expected to be in the range of 600 million euros ($684 million).

The main features of DST include the following:

- 1. DST will apply only to organisations which, individually or as a group:

- Record total worldwide revenues equal to or greater than €750 million; and

- Obtain total revenues from domestic digital services equal to or greater than €5.5 million.

The above parameters apply to both foreign and Italian entities.

- Revenues subject to DST include those deriving from advertising services, intermediation and marketplace, and data transmission. “Advertising” refers to the placing of (an) advertisement(s) on a digital interface, targeting the users of that interface; “intermediation and marketplace” refers to those platforms that offer a multilateral digital interface allowing users to contact and interact with each other and facilitating the direct supply of goods or services; “data transmission” refers to the transmission of data collected by users and generated by the use of a digital interface.

DST also includes taxation of the transactions carried out in the marketplace, including the intermediation in the sales of goods, while transactions concluded directly with final consumers and pure e-commerce transactions still seem to be out of scope.

- Business to business transactions relating to digital services are excluded from the scope of the tax.

- Revenues that are subject to taxation are generally linked to the location of the users of the services: they are considered taxable if the user of a taxable service is located in Italy in a specific tax period. The localization rules vary depending on the type of services. In particular, based on the current wording of the DST legislation: (i) revenues deriving from advertising services will be taxed when they appear on the user’s device where the device is used in Italy to access a digital interface in that tax period; (ii) in the case of intermediation or marketplace services, the localization of the user depends on whether the service involves a multilateral digital interface that facilitates the corresponding supply of goods or services directly between users. In the first case, revenues attract taxation in Italy where the user uses a device in Italy to access the digital interface and concludes a transaction on that interface during that tax period; failing that, the will be deemed to be located in Italy if they have an account that allows them to access the digital interface and this account has been opened using a device in Italy during that tax period; (iii) in the case of data transmission, the localization depends on whether the data transmitted was generated by a user who used a device in Italy to access a digital interface during that current tax period or a previous tax period.

- In accordance with the proposals made by the EU DST will apply at a rate of 3 percent and will be based on revenues generated in each quarter. The taxable base will not be reduced by any “costs” but it will be exclusive of value-added tax and other indirect taxes. There is no indication of whether non-deductible costs include traffic acquisition costs

- DST is not, in principle, deductible from income (for the application of Corporate Income Tax)

- Non-resident entities, which in the course of a calendar year fall within the scope of DST, but which lack a permanent establishment in Italy or a VAT number will have to request a DST identification number from the Italian Revenue Agency. If a non-resident has an affiliate company in Italy, the affiliate will be jointly responsible for compliance with the group’s DST obligations.

FRANCE

France is the first EU Member State to have implemented a DST.

This “tax of the 21th Century”[1] entered (retroactively) into force on 1st January 2019.

The DST has been dubbed the “GAFA tax” (an acronym of the main US targets: Google, Apple, Facebook and Amazon). However, contrary to what this acronym suggests, the French GAFA tax does not only target US groups but also other international groups including French, Chinese, German Spanish and English groups. Indeed, the French tax administration has estimated that around 30 international groups could be impacted by this tax.

The scope of the French GAFA tax relates to the value of digital services supplied in France. The business activities falling within the scope of the DST are: the supply of a digital platform allowing users to interact with other users and notably in order to facilitate the direct provision of goods or services between users; and the supply of services to advertisers which aim at placing on a digital platform targeted advertising content generated by personal data collected on digital platforms.

The supply of a digital platform relates to the location of users. Where one of the users of a platform is located in France during the relevant tax year, the service will be considered to have been provided in France.

The French GAFA tax does not apply to platforms for which collection of the users’ data is not a main objective. Provided the businesses principally use the digital interface to supply users with the following services, the supply of the digital platform should not be taxable:

- digital content such as e commerce, video services, music on demand;

- communication services;

- regulated payment services.

Where the digital interface is used to manage specific regulated financial systems and processes such as payment settlement, the supply of the digital platform should not be taxable.

Furthermore, where main purpose of the digital platform is to facilitate the purchase or sale of services to place adverts, the supply of the digital platform will not be taxable but the supply of these services to advertisers will be taxed.

These services will be deemed to be supplied in France during the relevant tax year if the following conditions are met:

- where the digital platform allows the provision of supplies of goods and services directly between users: a transaction is concluded during the relevant tax year by a user located in France

- for other kinds of platform: at least one user opens an account from France during the relevant tax year allowing the user access to all or some of the services available on the digital platform

In terms of services to advertisers: these services may include acquisition, storage and delivery of adverts, advertising control and advert performance measurement as well as user’s data transmission and management.

These services will be deemed to be supplied in France during the relevant tax year where the following conditions are met:

- where the service relates to the sale of data generated or collected from users activities on digital platforms: when the data sold during the relevant tax year are derived from the consultation of one of these digital platforms by a user located in France

- in the other cases: when an advert is placed on a digital platform during the relevant tax year which relates to data derived from a user consulting this digital platform while located in France

Intercompany transactions are excluded from the GAFA tax.

The GAFA tax sets out two key thresholds, both of which must be met by businesses for the DST to apply: €750 million annual worldwide turnover for digital services, and €25 million domestic turnover on digital services localized in France.

France adopted the rate suggested in EU’s proposals, applying a 3 % tax on the revenues derived from any digital services meeting the criteria set out above. The person liable to pay is deemed to be the company which receives payment for the relevant digital services. The taxable sum will therefore depend on what proportion of the payments is related to France, the type of services and the type of platform.

Any payments received in relation to the supply of a digital platform facilitating the sale of manufactured goods should not be taken into account.

Unlike the UK tax, the French GAFA tax is not deductible from corporate income tax. It is, however, deductible from another French tax named C3S (formerly known as “Organic tax”). This deduction mechanism has prevailed over deduction of the DST from Corporate Income tax, because French legislators wanted to avoid a requalification of this tax under bilateral treaties. However, the French Association of Internet Community Services (ASIC) has recently suggested that this tax deduction mechanism should be considered State aid and that the EU Commission should be notified.

In terms of the compliance burden on impacted business, the administrative reporting and compliance framework of the DST tax will be aligned with the existing VAT framework. For most of the affected companies, the 2019 instalment (based on the payments received in 2018) will need to be declared on their 2019 October VAT return (to be filed in November 2019) when declaring monthly VAT returns. Otherwise, the instalment will need to be paid on the 25 November 2019 at the latest.

Recently, President Trump had indicated that there would be retaliatory action on certain French wine imports if the French DST was implemented.

Following their Summit in Biarritz, France in August 2019, the leaders of the G7 group of nations issued a brief declaration on the International DST. Emmanuel Macron stated that if an international agreement on DST is agreed, the French DST tax will be repealed. The French president also mentioned that if any tax rate adopted by the international DST is lower than the tax rate adopted by the French DST, the difference would be refunded to businesses.

The tax is expected to raise €600 million euros annually.

SPAIN

In January 2019 the Spanish Government published its draft DST Bill. However, due to the current political situation in Spain (i.e. lack of government) the Bill has not yet been approved, and there is uncertainty as to how and whether this legal initiative will progress.

The Spanish Government has projected that it will raise €1.200m per year through DST.

The main features of this draft bill are as follows:

- DST is acknowledged to be an indirect tax and as such it would not fall within the scope of Double Taxation Treaties signed.

- Entities which meet the following requirements: (i) net revenues during the prior calendar year exceeding €750 million, and (ii) the total value of revenue derived from the development of the activities subject to DST in Spain exceeds €3 million.

The entities are not required to be established in Spain.

In the case of corporate groups these requirements would be assessed at the group level. Thus if both requirements are met on a group level, every group company providing the relevant digital services in Spain would be liable to DST regardless of the individual amounts of revenue.

- Taxable revenues are those arising from the following activities: (i) online advertising services; (ii) data transmission services; and (iii) intermediation services.

- Location of the users of the services: digital services are deemed to have been carried out within the Spanish territory whenever the user is located in Spain. Particular localization rules have been set for each type of taxable digital service.

- Taxable base: overall revenues obtained from the aforementioned activities, exclusive of VAT, constitute the DST taxable base.

- Tax rate: Spain has also decided to adopt the rate suggested by the EU proposal and the DST will apply at a rate of 3 per cent.

- Tax returns/forms: DST returns would be filed on a quarterly basis.

The Spanish DST Bill acknowledges that the foregoing rules are aimed at covering an intermediary period until the European DST Directive is finally approved, in which case local regulations would be amended accordingly.

US tax advisor for international clients in Spain. Connect with us for expert guidance.

POLAND

At the beginning of March 2019, the Prime Minister’s office announced that the Polish budget would benefit from the introduction of a digital tax with a projected value of approx. PLN 1 billion per year. However in May, the Ministry of Finance postponed a further announcement to this effect.

In July, the Ministry of Finance announced that it was working on a draft bill for the taxation of certain digital services, the starting point of which would be the draft EC directive adopted in March 2019.

The plan to introduce a digital tax was also included in the Official Financial Plan of Poland for 2019-2022. The tax was scheduled to come into force from 1 January 2020. This document projects that the digital tax is expected to bring about PLN 217.5 million to the budget next year.

At the end of August, the government presented a draft budget for 2020, which did not include a digital tax.

At the beginning of September during his visit to Poland, Vice President Pence said at a press conference that the US “deeply gratefully accepted the rejection” of Poland’s proposal for a digital service tax in another demonstration of the geopolitical impact of such a tax. The following day, the head of the Prime Minister’s office, Mr Michał Dworczyk, stated that there is currently no work being carried out in Poland regarding this tax.

Subsequently, the Ministry of Finance said that, although no receipts from this tax were recorded in the draft budget for 2020, the Ministry will continue to engage in discussions at the EU and OECD forums.

On 5 September, the Prime Minister said that the Polish government would implement a harmonised digital tax that would apply in the European Union. “We are waiting for solutions proposed by Brussels and the OECD” and “at the political and implementation level works were ceded at this stage to the EU level”.

Currently, it seems that the Polish government will not implement a digital tax, but will wait for the EU initiative.

Annex I

Overview of the progress of implementation by EU Member States

Should you require the help of a US tax specialist in the United Arab Emirates, please don’t hesitate to contact us.