I have previously discussed subpart F –

https://www.mooresrowland.tax/2018/02/us-exposed-owner-of-international.html

https://www.mooresrowland.tax/2020/02/the-tax-cuts-and-jobs-acts-impact-on.html

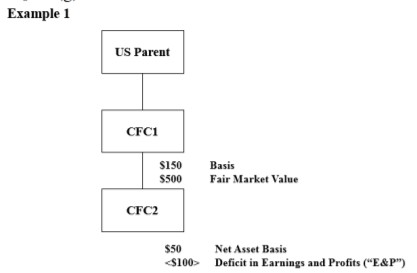

Consider first a fact pattern where a U.S. parent owns CFC1, which sells the stock of CFC2.

1. CFC2 was originally formed by CFC1, which invested $150 in the stock of CFC2.

2. CFC2 has incurred operating losses of $100 and has $50 of remaining basis in its assets.

3. CFC1 sells CFC2 to an unrelated buyer for $500, and the question is whether or not the seller wants to cause the transaction to be treated as a deemed asset sale for U.S. tax purposes by means of a §338(g) election or a ‘‘check-and-sell’’ transaction.

4. On a stock sale without any elections, CFC1 would recognize a $350 gain, all of which would generally be taxable to US Parent as passive basket, subpart F income under §954(c).

5. To the extent CFC1 incurred taxes on the sale, those taxes could be claimed as a foreign tax credit under §960(a).

6. Assume no other foreign tax credits would be available in the passive basket to shelter this gain.

7. Assuming no foreign tax on CFC1’s sale of stock, the $350 gain would be subject to full U.S. taxes at 21% ($73.5 of federal tax).