Search Results for: domicile uk

Related Sites

- Advanced American Tax

- Advanced American Tax (UK)

- Hayden T Joseph CPA LLP

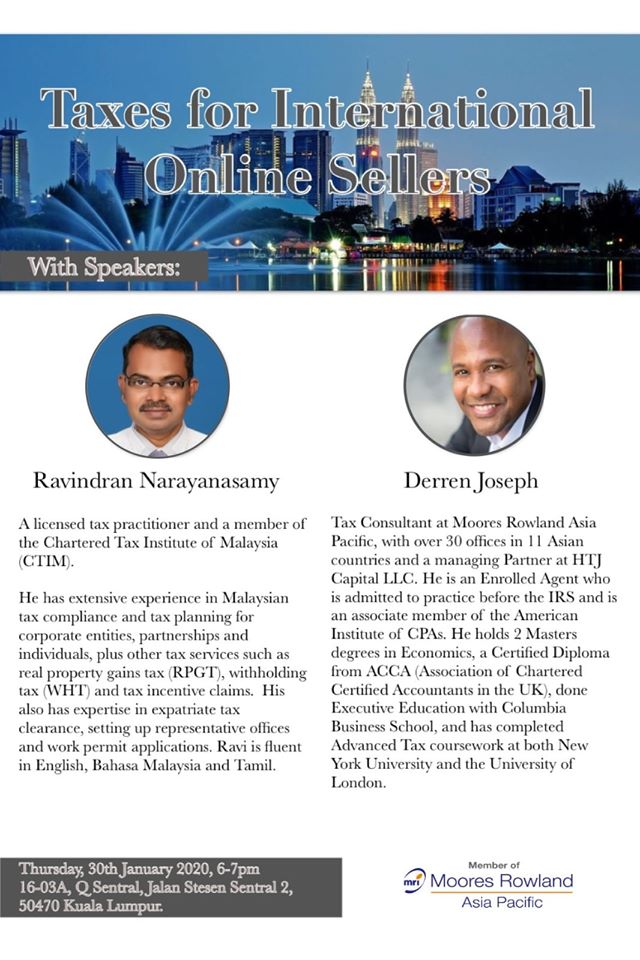

- Moores Rowland China

- Moores Rowland Hong Kong

- Moores Rowland India

- Moores Rowland Indonesia

- Moores Rowland Japan

- Moores Rowland Malaysia

- Moores Rowland Philippines

- Moores Rowland Taiwan

- Moores Rowland Thailand

- Moores Rowland Singapore

- Moores Rowland Vietnam

- Moores Rowland Asia Pacific

- Taxes for Digital Nomads

- Moores Rowland Australia