November 2023 Update

NHR has been dramatically changed

The NHR as we have known for several years is indeed about to end on 31 December 2023.

Having said this, if you still want to access the “old NHR” after 31 December 2023, you will need to assess whether you fall under one of the grandfathering provisions set out below:

- Having a procedure, initiated by December 31, 2023, of granting a residence visa or residence permit, with the competent entities, in accordance with the current legislation applicable to immigration matters, namely through the request for an appointment or actual appointment for submission of the request for the granting of a residence visa or residence permit or, also, by submitting the request for the granting of a residence visa or residence permit; or

- Having a residence visa or residence permit valid until December 31, 2023; or

- Having a promissory or employment contract, promise or secondment agreement signed by December 31, 2023, whose duties must take place within national territory; or

- Having a lease contract or other contract granting the use or possession of property in Portuguese territory concluded until October 10, 2023; or

- Having a reservation contract or promissory contract for the acquisition of real rights over property in Portuguese territory concluded by October 10, 2023; or

- Having dependents enrolled at an educational establishment domiciled in Portuguese territory, completed by October 10, 2023.

For the avoidance of doubt, current NHR beneficiaries and taxpayers that, on 31 December 2023, are registered as NHR, will be able to benefit from the regime until the end of the 10-year period.

The state budget has introduced a new tax incentive, especially for people who teach in higher education or do scientific investigations or come to work for Startup companies.

In addition to the workforce mentioned earlier, the workers who are “qualified for job positions recognised by the Agency for Investment and Foreign Trade of Portugal, E.P.E., or by IAPMEI – Agency for Competitiveness and Innovation, I.P., as relevant to the national economy, particularly within the framework of attracting productive investment” and “job positions or other activities carried out by tax residents in the autonomous regions of the Azores and Madeira, under the terms to be defined by regional legislative decree” are also eligible for this new tax benefit.

Moreover, people who work for certified startups are eligible for this new tax benefit. Startups are defined as companies with no more than 250 employees, an annual turnover of no greater than 50 million euros, and less than 10 years in operation. They must also have their headquarters or representation in Portugal, or at least 25 employees within the country. Furthermore, they cannot be a merger or division of a larger company.

These are still alternative paths for the Non-Habitual Resident (NHR) Tax Regime for those who wish to benefit from a more favourable tax regime in Portugal.

Our team is the only international tax team with a physical presence in Portugal that includes BOTH Portugal qualified professionals and US qualified professionals. We help with both tax planning and compliance as well as assist with streamlined tax amnesty in Portugal.

In terms of tax planning, we work with private clients in advance of a move to either country. We help them understand the tax implications of the move as well as ways of optimizing their cross border tax position.

For those who may be already exposed to multiple tax systems including Portugal, we work with them to do annual returns.

According to the Portuguese tax law in force since January 2015, an individual is deemed to be resident in Portugal for tax purposes if one meets either of the following conditions:

- Spends more than 183 days, consecutive or not, in Portugal in any 12-month period starting or ending in the fiscal year concerned.

- Regardless of spending less than 183 days in Portugal, maintains a residence (i.e. a habitual residence) in Portugal during any day of the period referred above.

The PIT Reform introduced a partial residence concept, so that there is a direct connection between the period of physical presence in Portuguese territory and the status of tax resident.

Thus, as a rule, the taxpayer will become resident in Portugal as of the first day of stay in the Portuguese territory and non-tax resident as of the last day of stay in Portugal, with a few exceptions.

Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 14.5% to 48% for 2021.

Non-residents are liable to income tax only on Portuguese-source income, which includes not only that portion of remuneration that can be allocated to the activity carried out in Portugal but also remuneration that is borne by a Portuguese company or permanent establishment (PE).

Non-residents are taxed at a flat rate of 25% on their taxable remuneration in 2021.

For the purpose of applying the tax rate, the taxable income is divided by two if the taxpayers are married and not judicially separated, as well as in the case of de facto marriages, whatever the circumstances, should they opt for joint taxation.

Special rates apply to capital gains and investment income. In 2021, an additional solidarity rate, which varies between 2.5% and 5%, applies to taxpayers with a taxable income exceeding EUR 80,000.

Social security contributions

Social security contributions are shared by the employee and the employer. The contributions are due on the employee’s gross remuneration at rates of 11% and 23.75% by the employee and the employer, respectively. These contributions cover family, pension, and unemployment benefits.

Foreign residents may be exempt from social security in Portugal if they contribute to a compulsory social security system in a European Union (EU) country or a country that has a bilateral social security agreement with Portugal, provided they are in possession of the relevant certificate of coverage.

In addition to social security contributions at a general rate of 23.75%, employers must buy an insurance premium to cover occupational accidents. The premium varies according to work and risk classification.

Regarding members of the board, the social security rates correspond to 9.3% with respect to the individual contributions and 20.3% for employer contributions. However, the contribution rate applicable to members of statutory boards who are considered as managers or administrators is set at rates of 23.75% and 11% to employers and members of statutory boards, respectively. The contributions of members of statutory boards are based on their effective remuneration but subject to a monthly minimum income level of EUR 438.81.

Members of statutory boards who are considered as managers or administrators, and some types of self-employees, become entitled to protection in the event of unemployment.

The contributions rate applicable to self-employees corresponds to 21.4%. The monthly contribution basis for self-employees corresponds to 1/3 of the relevant remuneration determined in each reporting period and produces effects in that month and in the following two months. For the determination of the relevant remuneration of the self-employee, it is considered the income received in the three months previously to the reporting month. The relevant remuneration corresponds to 70% of the amount of services rendered and to 20% of the income related to the production and sales of products.

A 10% contribution rate is due by employers if 80% or more of the fees earned by the self-employee come from services for the same company, for the same person with a business activity, or to the same group. A 7% contribution rate is due by employers when the economic dependence of the self-employee varies between 50% and 80%. The contribution is payable upon the issue of a tax assessment by the social security authorities.

In 2021, the Portuguese monthly minimum wage is EUR 665.

Inheritance and gift taxes

Donation of property is taxed under the stamp tax at 0.8%.

Free acquisition of goods by individuals (inheritance and gifts) is taxed under the stamp tax at 10%

Non Habitual Resident (NHR) Program from those registered before the end of 2023

The NHR program is very nuanced and unfortunately it is often over simplified and people have the mistaken perception that you can “live in Portugal tax-free”. This is certainly not the case and the program is evolving. In fact there were big changes that came into play in 2020

In 2020, our Webinars on Portugal tax attracted just short of 400 people. Here’s a video where I give an update for 2020 –

We will do another in early 2021. See www.htj.tax for upcoming webinars

One thing that is not emphasized enough is that Portugal must be your center of life. Less experienced consultants would say that it is enough to just rent a room so you have an address and a rental contract registered. No this is certainly not correct. If your accommodation is registered with the local authorities by the landlord as a Alojamento Local (or Airbnb type accommodation) then the tax office may deem this insufficient to maintain Portugal tax domicile.

I had a very bad experience where I booked accommodation online from warmrental.com which was listed on housinganywhere.com. Unfortunately I did not follow my own advice and I paid a deposit without checking with my Portugal Tax Lawyer. She told me of the risk explained above a couple days after booking but days before I was due to move in. I lost over EUR2 000 as they refused my request for a refund. Times are hard in Portugal and rental agents are often desperate and will take any opportunity to pocket your money so please be careful. Get proper legal advice before ever handing over cash.

As to US taxes for expats in Portugal, please don’t hesitate to get in touch.

Taxation of Non Habitual Tax Residents

Under this regime, the following taxation rules apply:

- Foreign-source self-employment or sole trader income derived from an eligible occupation (see below), royalties, capital gains and investment or rental income will be exempt from Portuguese tax as long as they may be taxed in the source country either under a double taxation agreement or under the OECD model tax convention. In addition, such income must not be deemed Portugal-sourced under applicable Portuguese law, and must not be sourced from a blacklisted tax haven.

- Foreign-source employment income will be exempt from Portuguese tax as long as it is liable to tax (at whatever rate) in the source country either under a double taxation treaty or under the OECD model tax convention, and is not deemed Portugal-sourced under applicable Portuguese law.

- Pension income will be liable to a 10% flat tax in Portugal, as long as deemed as not being Portuguese sourced income under the applicable Portuguese law.

- If your occupation is eligible (see below), Portugal-source employment or self-employment / sole trader income will be taxed at a flat rate of 20%, while other Portugal-sourced types of income will be taxed at the normal rates applicable to resident taxpayers, the calculation of the applicable marginal tax rate taking into account all income, including exempt income.

- In Portugal there is no wealth tax or capital duty, and an inheritance or a gift received by a spouse, descendant or ascendant is tax exempt. Inheritance or gifts received by other individuals will be either not taxable under territoriality rules, or else may be subject to a flat 10% stamp duty.

Applicability of Double Taxation Agreements

One interesting feature of this regime is that many double taxation treaties (of which Portugal signed 79) grant the source country the possibility of taxing income paid to residents of the other country, although in practice many countries abstain from using this possibility so as to attract foreign investment. This means that in practice many types of income will often be zero-taxed in the hands of the “non-habitual resident”, since Portugal will not tax them merely on account that they may be taxed in the other country.

Taking the UK/Portugal treaty and 2 types of income as an example, if you are a resident of Portugal but receive income from the UK, then, in respect of such income, the UK has the power to:

- Tax dividends under article 10, although it does not if the recipient is not a UK resident

- Tax royalties under article 12, although it does not if the recipient is not a UK resident

I.e. if you receive dividends or royalties from a UK company, such income may be subject to tax in the UK under the UK/Portugal agreement. As a consequence, although in practice it will not be taxed in the UK, it will not be taxed in Portugal either if you benefit from “non-habitual resident” status. Capital gains deserve careful consideration. Under article 13, they are treated differently according to whether they originate from the disposal of immovable or movable property. While capital gains from the alienation of real estate may under the double taxation treaty be taxed in the country in which the property is located and will therefore be exempt in Portugal, capital gains from the alienation of other types of property (notably securities) are taxable only in the beneficiary’s country of residence. As such, capital gains from the sale of securities will be subject to tax in Portugal, currently at a flat rate of 28%. Before becoming a non-habitual resident of Portugal, tax advice should therefore be taken by anyone who anticipates significant capital gains from the sale of securities. This is, of course, only a superficial initial approach and it is recommended that you take proper tax advice in order to make sure all your circumstances are taken into account.

Stay Requirements

Although the individual must be deemed a resident of Portugal when he/she submits the application, there is no minimum stay requirement afterwards and it is even possible to stop being a Portuguese tax resident for one or more years without losing non-habitual resident status.

Eligibility Requirements

In order to qualify as a “non-habitual resident”, a Portuguese national or a foreign individual having the right to live in Portugal must register as a tax resident of Portugal after not having been resident in this country during at least the previous 5 years. It should be noted that under the law an unregistered individual will be deemed resident for tax purposes if he/she either spends more than 183 days in the country during a 12-month period, or has a place of abode in the country, “in a way that may lead to the supposition of an intention to keep and occupy it as a habitual home”. However, there is no minimum stay requirement for a Portugal-registered tax resident.

EU, EEA and Swiss citizens have an automatic right to live in Portugal, having the legal obligation of registering accordingly, and individuals of other nationalities must obtain a residence permit.

Recognition of non-habitual resident status is not automatic and is granted for a period of 10 years upon successful application to the Portuguese tax authorities up until March 31st of the year following that in which Portuguese residence was taken up.

In order to apply, all that is required is the filing of a request and of a statement to the effect that the applicant was not resident for tax purposes in Portugal during the 5 years preceding the arrival in Portugal. Only in the event the tax authorities have doubts concerning the truth of what is stated will they request additional documentation, which may include a tax residence certificate from the previous country and/or a document proving that the vital and economic interests of the applicant were centred in another country during the previous 5 years.

Official List of Eligible Occupations

The list of High Value-Added Professional Activities eligible to tax benefits applicable to employment and business income under the Non-Habitual Resident (NHR) tax regime, provided the professionals hold at least (a) a level 4 qualification under the European Qualifications Framework, or (b) level 35 of the International Standard Classification of Education, or (c) 5 years of duly proven professional experience, on the following occupations:

- General Managers, Executive Managers

- Administrative Managers, Commercial Managers

- Production Managers, Specialised Services Managers

- Hospitality, Restaurant, Retail and Other Services Managers

- Specialist Physicists, Mathematicians, Engineers and related Technologists

- Medicine Doctors

- Dentists and Stomatologists

- University and Higher Education Teachers

- ICT Technologists

- Authors, Journalists and Linguists

- Creative and Performance Artists

- Intermediate level Science and Engineering Technicians and Professionals

- ICT Technicians

- Market-oriented Farmers and qualified Agriculture and Animal Husbandry workers

- Market-oriented Forestry, Fisheries and Hunting qualified workers

- Industry, Construction and Handicraft qualified workers

- Plant and Machine Operators and Assembly Workers, namely operators of fixed installations and machinery

- Directors and Managers of businesses that promote productive investment in eligible projects that qualify for tax benefits under a concession agreement entered into under the Investment Tax Code.

Here’s the source in Portuguese – https://www.ine.pt/xportal/xmain?xpid=INE&xpgid=ine_publicacoes&PUBLICACOESpub_boui=107961853&PUBLICACOESmodo=2&xlang=pt

112 – Director-General and Executive Manager, of companies

112 General Manager and Executive Manager, Enterprise 1120 1120.0

It comprises the tasks and functions of the Managing Director and Executive Manager of undertakings, which consist, in particular, of:

- Plan, direct and coordinate the company’s activities

- Review the company’s operations and results and send reports to the board of directors and management

- Determine objectives, strategies, policies and programs for the company

- Draw up and manage budgets, control expenditure and ensure the efficient use of resources

- Monitor and evaluate company performance

- Represent the company in official meetings, board meetings, conventions, conferences and other meetings

- Select or approve the admission of company senior management

- Ensure that the company complies with the laws and regulations in force

It includes, inter alia, chairman of the board of directors [includes Sports Corporations (SAD)], executive director, hospital administrator, governor of Banco de Portugal, as well as members and

equivalents (executives and non-executives) that are part of the board of directors of the companies or organizations included herein.

Does not include:

- Senior Head officer of public administration (1112.0) •Head of special interest organisation (1114.0) •Chief Financial Officer (1211.0)

•Director of Strategy and Planning (1213.0)•Sales and Marketing Directors (1221)

12 – Directors of administrative and commercial services

12 Directors of administrative and commercial services

It comprises the tasks and functions of directors of administrative services (finance, human resources, planning, etc.) and commercial services (director of sales, marketing, public relations, research, development, etc.) in companies or in public administration.

Does not include:

- Senior head of institutions and companies (11) •Branch manager of financial institutions (1346.0)

121 Directors of business and management services

It comprises the tasks and functions of the chief financial, human resources, strategy, planning and other business and administration services, with particular focus on planning, organisation, direction, control and coordination.

1211 Chief Financial Officer 1211.0

It comprises the tasks and functions of the Cfowhich consist, in particular, of:

- Plan, direct and coordinate financial operations of a company or organization

- Assess the financial situation of a company or organization, prepare budgets and supervise financial operations

- Consult the Managing Director, Executive Managers and Directors of Other Departments

- Draw up and manage budgets, control expenditure and ensure the efficient use of resources

- Develop and direct operational and administrative procedures

- Supervise the selection, training and performance of the work team

- Represent the company or organization in negotiations with external bodies.

Does not include

- Senior head of institutions and companies (11)•Branch manager of financial institution and insurance (1346.0) •Bank branch manager (1346.0)•Auditor and statutory auditor (2411.0)•Accountant (2411.0)•Financial advisor (2412.0)

1212 Human Resources Director 1212.0

It comprises the tasks and functions of the Human Resources Director consisting in particular of:

- Plan, direct and coordinate the human resources of a company or organization

- Planning and organising human resource management procedures (recruitment, training, promotion,

transfer, dismissal of staff, etc.)

- Plan and organize negotiations and procedures to determine the structure and wage level

- Oversee occupational hygiene, health and safety programs

- Draw up and manage budgets, control expenditure and ensure the efficient use of resources

- Ensuring compliance with labour standards

- Consult the Director General and Directors of other departments

- Represent the company or organization in negotiations with external bodies.

Does not include:

- Senior head of institutions and companies (11) •Staff database manager (2521.0)

1213 Director of Strategy and Planning 1213.0

It comprises the tasks and functions of the Directors of Strategy and Planning consisting, in particular, of:

- Develop, implement and monitor plans, programmes, policies and strategies to achieve the objectives

- Develop, direct and participate in research and analysis policies

- Establish ways to measure activity and responsibility

- Lead and manage work team activities on strategies and planning

- Oversee the selection and performance of work teams on strategies and planning

- Consult the Director General and Directors of other departments

- Represent the company or organization in conventions, seminars, public consultations and forums.

Does not include:

- Senior head of institutions and companies (11)

1219 Other directors of business services and administration 1219.0

It comprises the tasks and functions of other directors of business and administration services, which consist in particular of:

- Provide administrative support, planning and advice to general directors in building management, administrative services and the like

- Develop and manage the resources, administrative and physical, of the organization

- Develop and implement administrative and procedural guidance for work teams

- Analyze issues and initiatives for managing the organization’s resources and prepare reports

- Provide information and support in the preparation of financial reports and budgets

- Lead, manage and develop work teams in the administrative area

- Represent the company or organization in conventions, seminars, public consultations and forums

- Supervise the selection and performance of work teams.

Does not include:

- Senior manager of institutions and companies (11) •Director of sales and marketing (122)•Director of purchasing, distribution and transport (1324)

122 Sales, marketing and business development directors

It comprises the tasks and functions of the directors of sales, marketing, advertising, public relations, development and research, with a particular focus on planning, organization, direction, control and coordination.

Does not include:

- Senior head of institutions and companies (11)

122.1 Sales and marketing directors

It comprises the professions of sales and marketing director, with special focus on the direction and coordination of sales and definition of the commercial policy of proposals or services of a company or organization, based on higher guidelines.

Sales Director

It comprises the tasks and functions of the sales director which consist, in particular, of:

- Define sales spaces of products and coordinate sales people’s work

- Establish price lists, promotions and product delivery

- Analyze markets to determine consumer needs and sales forecast

- Review seller reports and report on sales

- Direct and coordinate sales of products or services of a company or organization.

Does not include:

- Marketing Director (1221.2) •Purchasing Director (1324.1)

Marketing Director

It comprises the tasks and functions of the marketing director which consist so in particular of:

- Assess sales and business opportunities

- Establish and direct marketing activities procedures

- Draw up and manage budgets, monitor expenditure and ensure the efficient use of resources

- Study the market and participate in the preparation of advertising campaigns

- Define and direct the commercial policy of a company or organization from higher guidelines.

It includes, inter alia, commercial director.

Does not include:

- Sales Director (1221.1) •Director of Advertising (1222.1) •Purchasing Director (1324.1)

1221 Directors of advertising and public relations

It comprises the professions of directors of advertising and public relations, with a particular focus on the direction and coordination of advertising and public relations of a company or organization, from senior guidelines.

Does not include:

- Senior head of institutions and companies (11)

1222.1 Director of Advertising

It comprises the tasks and functions of the director of advertising consisting in particular of:

- Plan, direct and coordinate advertising for a company or organisation

- Negotiate advertising contracts with clients and media

- Study, launch and follow advertising campaigns

- Report on the results of advertising campaigns

- Lead and manage activities of the advertising work team.

Does not include:

- Marketing Director (1221.2)•Director of Public Relations (1222.2)•Director of Research and Development (1223.0)

1222.2 Director of Public Relations

It comprises the tasks and functions of the Director of Public Relations consisting in particular of:

- Prepare meetings, interviews and conferences with the media

- Contact the media and collaborate in the dissemination of information

- Contact services with public relations needs and coordinate information disseminated by the

media

- Plan, direct and coordinate the public relations of a company or organization

- Lead and manage activities of the public relations work team.

Does not include:

- Marketing Director (1221.2) •Advertising Director (1222.1)

1223 Director of Research and Development 1223.0

It comprises the tasks and functions of the Director of Research and Development consisting in particular of:

- Coordinate research activities and development of new products, processes and knowledge

- Define research and development programmes, specifying objectives and budgets

- Track surveys and report results

- Direct research and development activities carried out in the company or organization or

subcontractors to specialized entities to define new products and processes

- Lead and manage activities of the research work team.

Does not include:

- Marketing Director (1221.2) •Production Directors (13) •Researchers (2)

13 – Directors of production and specialized services

It comprises the tasks and functions of production directors in agriculture, animal production, forest, fisheries, processing and extractive industries, construction, transport and distribution, information and communication technology services and specialised services, enterprises and public administration.

Does not include:

- Senior head of institutions and companies (11)

131 Production directors in agriculture, animal production, forestry and fisheries

It comprises the tasks and functions of production directors in agriculture, animal production, forestry, fisheries and aquaculture, with a particular focus on planning, direction and coordination of production in agriculture, animal husbandland, forestry, fishing and aquaculture.

Does not include:

- Senior head of institutions and companies (11)

1311 Production directors in agriculture, animal production and forestry

It comprises the professions of production director in agriculture, animal and forestry production, with a particular focus on the planning, direction and coordination of production.

Does not include:

- Senior head of institutions and companies (11)

1311.1 Director of production in agriculture

It comprises the tasks and functions of the Production Director in agriculture which consist, in particular, of:

- Planning agricultural production tailored to market needs

- Prepare and manage budgets and activity reports, determine objectives and means for the implementation of the plans

- Register and monitor agricultural operations and work, observe regulatory and legislative provisions on agricultural activities

- Control soil types, fertilizers, equipment and other means that interfere with the quality and quantity of agricultural production

- Direct and coordinate agricultural activities (planting, irrigation, harvesting, fertilizer and pesticide application)

- Coordinate the implementation of occupational hygiene, health and safety standards

- Organise farm support structures (maintenance of buildings, water supply systems, equipment, etc.).

Does not include:

- Director of agricultural enterprise (1120.0) •Director of animal production (1311.2) •Director of forestry (1311.3)

1311.2 Director of animal production

It comprises the tasks and functions of the director of animal production consisting in particular of:

- Planning animal production tailored to market needs

2. Draw up objectives, means and prepare activity reports

3. Record and monitor activities related to animal production

4. Observe regulatory and legislative provisions on animal production

5. Coordinate the implementation of occupational hygiene, health and safety standards.

Does not include:

- Director of livestock production companies (1120.0) •Director of Agricultural Production (1311.1)•Director of production in fisheries and aquaculture (1312) •Breeder of pet animals or breeding animals (612)

1311.3 Director of forestry production

It comprises the tasks and functions of the director of forestry production consisting in particular of:

- Planning forest production tailored to market needs

- Develop objectives, means and activity reports

- Record and control operations linked to forest production

- Observe regulatory and legislative provisions on forestry

- Identify and control pests and diseases in forest production

- Coordinate the implementation of occupational hygiene, health and safety standards.

Does not include:

- Director of forestry production company (1120.0) •Director of Agricultural Production (1311.1)•Director of Animal Production (1311.2)•Director of Forest Protection (Safety) (1349.2)

1312 Production directors in fisheries and aquaculture

It comprises the professions of production directors in fisheries and aquaculture, with a particular focus on the planning, direction and coordination of production in fisheries and aquaculture.

Does not include:

- Senior manager of institutions and companies (111)

1312.1 Director of production in fisheries

It comprises the tasks and functions of the production director in fisheries consisting in particular of: 1. Plan catches and pick-up of sea products tailored to market needs

- Develop objectives, means and activity reports

- Record and control catches and pick-up of sea products and inland waters

- Observe regulatory and legislative provisions relating to the fishing or exploitation of maritime or inland waters, regardless of the type of resource

- Negotiate with buyers to arrange the sale of seafood

- Hire fishing operations with master or owner of the vessel

- Organise and conduct inspections of fish reserves to identify diseases or parasites

- Monitor environmental conditions to maintain or improve aquatic life

- Coordinate the implementation of occupational hygiene, health and safety standards.

Does not include:

- Director of fishing company (1120.0)•Director of aquaculture production (1312.2)•Director of the extraction of rocks and sands from the aquatic environment (1322.0)• Fishermen and skilled fishing workers in coastal and inland waters (6222) •Fishermen and skilled broad-fishing workers (6223)

1312.2 Director of aquaculture production

It comprises the tasks and functions of the director of production in aquaculture consisting, in particular, of:

- Plan aquaculture production tailored to market needs

- Develop objectives, means and activity reports

- Observe regulatory and legislative provisions on aquaculture

- Direct any aquaculture production, regardless of the type of aquatic organism produced and the purpose for which it is intended (commercial or repopulate)

- Develop and coordinate activities to increase fish incubation, growth rate and prevent disease

- Drive and monitor the transfer of adult fish to commercial lakes or tanks

- Coordinate the implementation of occupational hygiene, health and safety standards.

Does not include:

- Director of aquaculture production company (1120.0) •Director of production in fisheries (1312.1)•Harvesting of algae, shells and the like at sea or river (622) •Aquaculture and skilled aquaculture worker (6221)

132 Directors of the manufacturing, extractive, construction, transport and distribution industries

It comprises the tasks and functions of the directors of the manufacturing, extractive, construction, civil engineering, procurement, transport, warehousing and distribution industries, with a particular focus on the planning, organisation and coordination of these activities.

Does not include:

- General Manager and Executive Manager of the company (1120.0)

1321 Director of manufacturing 1321.0

It comprises the tasks and functions of the Director of Manufacturing, which consist so in particular of:

- Determine, implement and monitor production strategies, policies and plans (includes electricity production)

- Plan details of production activities (quality and quantity of products to be produced, costs, times and labor requirements)

- Develop and manage budgets, monitor production results and costs, adjust processes and resources to minimize costs

- Plan details of electricity, water and gas distribution, waste collection, treatment and disposal activities

- Supervise acquisition and installation of new facilities and industrial equipment

- Coordinate implementation of occupational hygiene, health and safety standards

- Identify business opportunities and determine products to be produced

- Supervise selection, training and performance of workers

It includes, inter alia, director of the production of goods, production and distribution of electricity, gas and water, of the collection, treatment and disposal of waste.

Does not include:

- General Manager and Executive Manager of the company (1120.0) •Director of extractive industries (1322.0) •In charge of the processing business (3122)

1322 Director of extractive industries 1322.0

It comprises the tasks and functions of the Director of extractive industries consisting in particular of:

- Negotiate with managers to determine production quotas and extraction plans, and develop policies for removing raw materials

- Assess the potential of production sites to determine workers, equipment and technologies to be used

- Plan details of the quality and quantity of products to be extracted, costs and labour needs

- Develop and manage budgets, monitor results and production costs, adjust processes and resources

- Supervise acquisition and installation of new equipment

- Coordinate the implementation of occupational hygiene, health and safety standards

- Investigate and implement regulatory and statutory requirements affecting mineral extraction operations and the environment

- Supervise the selection, training and performance of workers.

Does not include:

- General Manager and Executive Manager of the company (1120.0) •Director of manufacturing (1321.0) •Head of extractive industry (3121.0)

1323 Director of the construction and civil engineering industries 1323.0

It comprises the tasks and functions of the Director of the construction and civil engineering industries, which consist in particular of:

- Interpret architectural projects and specifications

- Coordinate human resources, contracts, delivery of materials and equipment

- Negotiate with owners, property developers and subcontractors involved in the construction process to ensure that the project is completed on time and on budget

- Prepare contract proposals

- Ensure that the work is in accordance with legislation and quality and safety standards

- Organise the submission of projects to local authorities

- Prepare construction under contract or subcontract specialized construction services

- Coordinate the implementation of occupational hygiene, health and safety standards

- Organise building inspections by the competent authorities

- Establish and manage budgets, control expenditure and ensure efficient use of resources

- Supervise selection, training and performance of workers or subcontractors.

Does not include

- General Manager and Executive Manager of the company (1120.0) •In charge of construction (3123.0)

1324 Directors of purchasing, transport, warehousing, distribution and related

It comprises the professions of directors of procurement, transport, storage and distribution, with a particular focus on the planning, management and coordination of purchases, transport, storage and distribution of companies or bodies from higher guidelines.

1324.1 Purchasing Director

It comprises the tasks and functions of the purchasing director which consist, in particular, of:

- Plan, implement and monitor purchases of goods allocated to the company’s activity

- Assess the needs of goods or raw materials according to service and stock requests

- Study conditions of delivery or distribution of goods, quality of products and their storage

- Check compliance with safety and hygiene standards of goods

- Negotiate contracts with suppliers

- Establish and manage budgets, control expenditure and ensure efficient use of resources.

Does not include:

- General manager or executive officer of the company (1120.0) •Sales Director (1221.1)

1324.2 Director of Transport

It comprises the tasks and functions of the Transport Director consisting in particular of:

-

- Planning and implementing standards for the effective exploitation of transport

- Organize work and set schedules and rates

- Check compliance with occupational hygiene, health and safety standards

- To drive any means of transport (by road, rail, air or sea), regardless of whether it is used to the transport of goods or persons.

Does not include:

- General Manager or Company Executive (1120.0)

1324.3 Directors of storage, distribution and related

It comprises the tasks and functions of the directors of storage, distribution and related consisting, in particular, of:

-

- Plan, implement and monitor storage and distribution strategies, policies and plans

- Supervise systems for recording the movements of goods, ensuring their requisition and replenishment in good time

- Establish contacts with departments and customers, for moving goods and rerouting for transportation

- Track asset distribution records

- Draw up and manage budgets, control expenditure and ensure the efficient use of resources 10. Check compliance with occupational hygiene, health and safety standards

Does not include:

- Managing director of storage, distribution and related companies (1120.0)

133 Directors of information technology services 1330 and communication (ICT)1330.0

It comprises the tasks and functions of the Directors of Information and Communication Technology (ICT) services consisting in particular of:

- Consult users, managers, vendors and technicians, to assess computer equipment needs, system requirements and specify the technology to be used

- Formulate and direct ICT strategies, policies and plans

- Direct the selection and installation of ICT equipment and provide training

- Direct ICT operations, analyse workflows, set priorities, develop standards and set deadlines

- Oversee the security of information and communication technology systems

- Assign, manage and lead the work of system analysts, programmers and other computer workers

- Assess the use and needs of ICT in an organisation

- Draw up and manage budgets, control expenditure and ensure the efficient use of resources

- Represent the company or organisation in ICT conventions, seminars and conferences

It includes, inter alia, director of application development, information systems, information technologies and data processing.

Does not include:

- General Manager of information and communication companies (1120.0) •Analyst and programmer (251)•Computer network specialist (2523.0)

134 Directors of specialised services

It comprises the tasks and functions of service directors (childcare, health care, the people of the old, education, social support, bank, insurance, library, museum, art galleries, national monuments, security forces and services, legal services, prisons, etc.), with a particular focus on planning, management and coordination of these activities, in companies and in the Public Administration.

1341 Director of Childcare Services 1341.0

It comprises the tasks and functions of the Director of ChildCare Services consisting in particular of:

- Plan and implement programs that enable physical, emotional, intellectual and social development of children

- Prepare and monitor budgets

- Supervise and coordinate the provision of childcare (before or after school, daily or in holiday centres)

- Direct and supervise childcare professionals

- Manage facilities and ensure that buildings and equipment provide safety conditions for children and workers

- Interpret safety legislation and take measures to comply with the regulations

- Prepare and maintain childcare records and accounts

- Recruit and evaluate the work team.

Does not include:

- Director of child health care (1342.0) •Director of child support services (1344.0) •Director of child education services (1345.0)

1342 Director dos serviços de saúde 1342.0

It comprises the tasks and functions of the Director of Health Services consisting in particular of:

- Provide general guidance and management for a service, facility, organization, or plant

- Direct, supervise and evaluate the activities of doctors, nurses, technical, administrative and other health services

- Set objectives and evaluate the units it manages

- Directing or conducting the selection and training of human resources

- Develop, implement and monitor procedures, policies and performance standards for physicians, nurses, technical and administrative personnel in the health area

- Monitor the use of diagnostic means, bedsfor inpatient, facilities and human resources to ensure its efficient use

- Control the preparation of budgets, the preparation of reports and expenses in accessories, equipment and services

- Liaise with health and wellness service providers, management bodies and funding to coordinate the provision of services

- Advise state bodies on measures to be taken to improve health services and facilities

- Represent the organization in negotiations, conventions, seminars and public consultations on health services

It includes, inter alia, clinical director, health care coordinator, director of nursing and head nurse.

Does not include:

- Hospital administrator or general manager (1120.0) •Director of childcare services (1341.0) •Director of Care for the Elderly (1343.0)•Specialist doctors (2212)

- Specialist nurses (222)

1343 Director of care services for the former 1343.0

It comprises the tasks and functions of the Director of Care Services for the Old Persons consisting in particular of:

- Provide general guidance and management for a service, facility, organization, or plant

- Direct, supervise and evaluate the activities of doctors, nurses, technical, administrative and other services

- Set objectives and evaluate the units it manages

- Directing or conducting the selection and training of human resources

- Develop, implement and monitor procedures, policies and performance standards for nurses, personal care personnel, administrative and other care personnel for the elderly

- Liaise with health and wellness service providers, management bodies and funding to coordinate the provision of services

- Advise government bodies on measures to be taken to improve health and welfare services for the old

- Represent the organization in negotiations, conventions, seminars and public consultations on care for the old

It includes, inter alia, director of aged care centres, community care coordinator and director of nursing home.

Does not include:

- Director of Health Services (1342.0) •Specialist physicians (2212) •Specialist nurses (222)

1344 Director of social support services 1344.0

It comprises the tasks and functions of the Director of Social Support Services consisting in particular of:

- Provide general guidance and management for a service, installation, and organization of the center

- Develop, implement and monitor procedures, policies and standards for the workforce

- Monitor and evaluate resources for the provision of welfare, housing and other social services

- Control the preparation of budgets, preparation of reports and expenses in equipment and services

- Develop contacts with welfare and health service providers, management and financing bodies to discuss areas to be cooperated and coordinated

- Advise government bodies on measures to be taken to improve social services and facilities

- Represent the organization in negotiations, conventions, seminars and public consultations on social support

- Develop and manage budgets, control expenditure and ensure efficient use of resources

- Supervise the selection, training and performance of human resources

It includes, inter alia, director of community centres, family assistance services, social housing and social assistance centre.

Does not include:

- Director general of organisation of special interest (1114.0) •Director of childcare services (1341.0) •Director of care services for the older (1343.0)

1345 Director of Education Services 1345.0

It comprises the tasks and functions of the Director of Education Services consisting in particular of:

- Develop the educational project of the institution, based on the structure defined by the educational authorities and the State

- Implement systems and procedures to monitor school performance and student enrollment

- Define and submit to the approval of the competent bodies of the institution the annual and multiannual plans of activities, the annual activity report and the rules of procedure

- Conduct management activities related to the admission of students, constitution of classes, preparation of schedules and distribution of teaching and non-teaching services

- Control the preparation of budgets, preparation of reports and expenses in equipment and services

- Lead and guide teachers, staff and students

- Collaborate in the process of evaluating the work of teachers, (includes invited teachers) visiting classrooms, observing teaching methods, reviewing pedagogical objectives and analyzing teaching material

- Promote educational programs and represent the service or institution in the community

- Develop and strengthen disciplinary standards to create a safe and conducive environment for students, teachers and staff

- Control the selection, training and supervision of human resources

It includes, inter alia, director of college, school and university rector.

1346 Director of branches of banks, financial services and insurance 1346.0

It comprises the tasks and functions of the director of branches of banks, financial services and insurance, which consist, in particular, of:

- Plan, direct and coordinate human resources activities at the branch

- Establish and maintain customer relationships

- Advise and support financial and insurance clients

- Review, evaluate and process loan or insurance applications

- Monitor credit operations and conduct financial investigations

- Oversee cash flows, financial instruments and preparation of financial and regulatory reports

- Approve, reject or coordinate commercial credit lines, personal loans or real estate

- Coordinate cooperation with company branches

- Manage budgets, control expenditures and ensure efficient use of resources

- Supervise the selection, training and performance of human resources

It includes, inter alia, managers of bank and insurance agency, credit union and real estate credit society.

Does not include:

- Chairman or General Manager of Financial and Insurance Institutions (1120.0) •Chief Financial Officer (1211.0)•Credit and Loan Agent (3312.0)•Insurance Agent (3321.0)

1349 Directors of other specialised and professional services with command, management or leadership roles of security forces and services

It comprises the tasks and functions of directors of libraries, archives, museums, art galleries, national monuments and other specialized services, n.e., as well as officers and other professionals of the security forces and services, with functions of command, direction or leadership, with special focus on the planning, direction, coordination and evaluation of professional and technical services.

1349.1 Director of libraries, archives, museums, art galleries and national monuments

It comprises the tasks and functions of the director of libraries, archives, museums, art galleries and national monuments, which consist, in particular, of:

- Direct and manage libraries, archives, museums, art galleries and national monuments 2. Develop, implement and monitor human resources procedures, policies and standards 3. Direct, supervise and evaluate activities of technical, administrative and other service personnel

- Control the preparation of budgets, preparation of reports and expenses in equipment and services

- Coordinate cooperation with other similar services

- Manage budgets, control expenditures and ensure efficient use of resources 7. Supervise the selection, training and performance of human resources.

Does not include:

- Senior Head of Public Administration (1112.0) •Head of special interest organisations (1114.0) •Director of recreational and cultural arts (1431.0) •Librarian, archivist, museum curator and the like (262)

1349.2 Officers and other officers of the security forces and services, with command, directorate or leadership functions

It comprises the tasks and functions of officers and other professionals, of the security forces and services, with functions of command, direction or leadership, consisting, in particular, of:

- Command, direct, lead, coordinate and control territorial units (district, regional or metropolitan), divisions, police forces, and other security services, in the strategic, operational and tactical level

- Direct, coordinate and control commands, units, establishment, subunits and forces constituted of GNR

- Develop, implement and monitor human resources procedures, policies and standards

- Command, direct, supervise and evaluate the activities of security forces and services professionals

- Manage budgets, control expenditures and ensure efficient use of resources

- Command, direct, lead and coordinate teams and services of security forces and services

- Coordinate cooperation with other similar services

- Supervise selection, training and performance of security service professionals

- Assist the commander, director or chief in the functions of command, direction and head

It includes, inter alia, officers and sergeants of the GNR, with functions of leadership, officers and chiefs of police of the PSP, director and deputy director of territorial units of the JUDICIARY, regional and local commanders of the Maritime Police and other professionals with functions of command, direction or head of the forces and security services.

Does not include:

- Officers of the Armed Forces (011)•Sergeants of the Armed Forces (021)•National Director and General Commander of Security Forces and Services (1112.0)•Director of human resources of security forces and services (1212.0) •Director of social services for security forces and services (1344.0) •Director of police educational establishments (1345.0)•Sergeant of the GNR without leadership function (5412.1)

1349.3 Director of other specialised services, n.e.s.

It comprises the tasks and functions of the Director of other specialised services, n.e. which consist, in particular, of:

- Direct and manage legal, prison, fire and other specialised services

- Develop, implement and monitor human resources procedures, policies and standards

- Directing, supervising and evaluating the activities of the professionals of these services

- Plan, direct and coordinate the operation of services

- Manage budgets, control expenditures and ensure efficient use of resources

- Coordinate cooperation with similar services

- Supervise the selection, training and performance of human resources

It includes, inter alia, director of prisons, director of legal services, director of the conservatoire and intermediate officers of the Public Administration not classified in other professions.

Does not include:

- Commander of military forces (0)•Senior Head of Public Administration (1112.0) •Head of special interest organisations (1114.0) •Director of national sites and monuments (1349.1) •Director of recreational and cultural centre (1431.0)

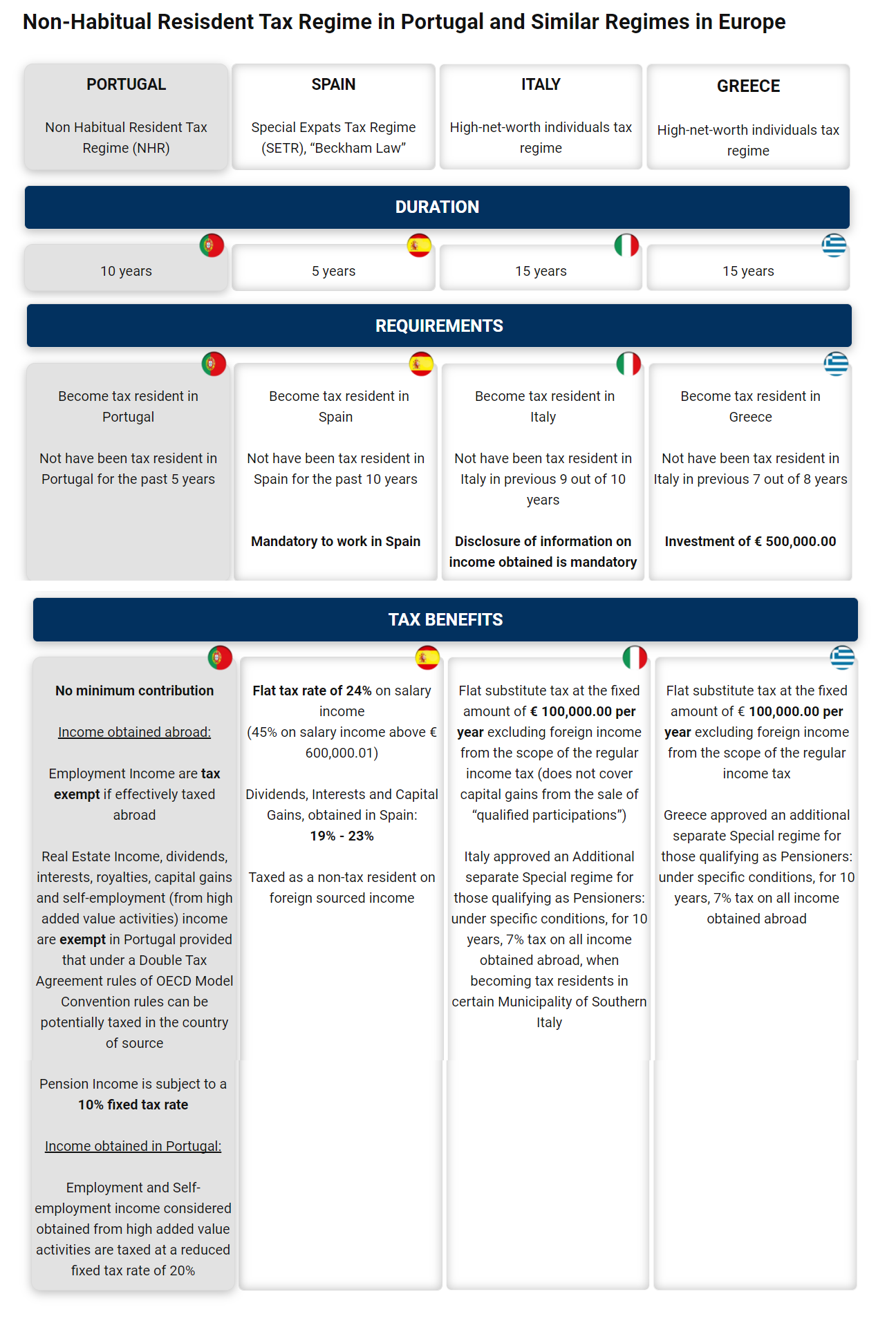

Non-Habitual Resident Tax Regime in Portugal in comparison to Similar Regimes in Europe

Here’s the 2021 list of Portugal’s blacklisted jurisdictions for your consideration. This would be critical as you review your corporate structure

List of countries, territories and regions that provide a more favorable tax regime than NHR

| Countries, territories and regions |

|---|

| American Samoa | Liechtenstein |

| Anguilha | Maldive Islands |

| Antigua and Barbuda | Marshall Islands |

| Aruba | Mauritius |

| Ascension Island | Monaco |

| Bahamas | Monserrat |

| Bahrain | Nauru |

| Barbados | Netherlands Antilles |

| Belize | Northern Mariana Islands |

| Bermuda | Niue Island |

| Bolivia | Norfolk Island |

| British Virgin Islands | Pacific Islands (2) |

| Brunei | Palau Islands |

| Cayman Islands | Panama |

| Channel Islands (1) | Pitcairn Island |

| Christmas Island | Porto Rico |

| Cocos (Keeling) | Qatar |

| Cook Islands | Queshm Island |

| Costa Rica | Saint Helena |

| Djibouti | Saint Kitts and Nevis |

| Dominica | Saint Lucia |

| Falkland Islands or Malvinas | Saint Pierre and Miquelon |

| Fiji Islands | Samoa |

| French Polynesia | San Marino |

| Gambia | Seychelles |

| Gibraltar | Solomon Islands |

| Grenada | St Vicente and the Grenadines |

| Guam | Sultanate of Oman |

| Guyana | Svalbard (3) |

| Honduras | Swaziland |

| Hong Kong | Tokelau |

| Isle of Man | Trinidad and Tobago |

| Jamaica | Tristan da cunha |

| Jordan | Turks and Caicos Islands |

| Kingdom of Tonga | Tuvalu |

| Kiribati | United Arab Emirates |

| Kuwait | United States Virgin Islands |

| Labuan | Vanuatu |

| Lebanon | Yemen Arab Republic |

| Liberia | Uruguay |

(1) Includes Alderney, Guernsey,Great Stark, Herm, Little Sark, Brechou, Jethou, Jersey and Lihou.

(2) Remaining Pacific Islands not included in this list.

(3) Spitsbergen Archipelago and Bjornoya Island.

Value Added Tax (VAT) in Portugal

Value Added Tax (VAT) is a tax levied on sales or supplies of services in Portugal. There are three VAT rates: the standard rate of 23% (22% in the Autonomous Region of Madeira; 18% in the Autonomous Region of the Azores), the intermediate rate of 13% (12% in Madeira; 9% in the Azores), and the reduced rate of 6% (5% in Madeira; 4% in the Azores). VAT is paid by consumers when paying for goods or services supplied. The seller ofservice provider receives the VAT and then pays it to the Tax and CustomsAuthority (AT).

This page provides information on the following:

Registration to Pay Value Added Tax (VAT)

Natural persons (self-employed persons) or legal entities (companies) that produce, market or provide services in Portugal have to pay taxes, and are required to submit a declaration of commencement of activity.

Self-employed persons are not obliged to declare the start of their activity if they only issue a single invoice (once in the course of the year for the sale of goods or provision of services) which does not exceed EUR 25 000.

For more information, please refer to Article 2 of the Value Added Tax (VAT) Code.

Reporting Commencement of Activity

Before starting an activity, a self-employed person or company must submit a declaration of commencement of activity.

For companies that are registered at a business registry, the declaration of commencement of activity must be submitted no later than 15 days after registration.

The declaration must be submitted by:

- the self-employed person, company or a tax representative, whenever they do not have organised accounts

- the certified accountant of the self-employed person or company, should they have organised accounts.

Accounts must be maintained whenever annual income is estimated to be more than EUR 200 000. Should lower income have been predicted, you may opt for organised accounting at any time.

For more information on accounting schemes, please see the Tax and Customs Authority information leaflet.

The declaration may be submitted:

- via the Tax and Customs Authority website

- at any Tax and Customs Authority department

- at a Citizens’ Bureau (Loja de Cidadão), when submitted by a self-employed person.

For more information please see the Frequently Asked Questions page of the Tax and Customs Authority website or the activity commencement manual.

Appointing a tax representative to submit the declaration

Self-employed persons or companies without an established address in Portugal but which have an established address in another Member State of the European Union may submit the declaration of commencement of activity through a representative with a tax address in Portugal.

Self-employed persons or companies without an established address in Portugal or a in Member State of the European Union are obliged to appoint a tax representative in Portugal.

For more information please see the Frequently Asked Questions page of the Tax and Customs Authority website.

Reporting changes in activity

Companies not registered in the commercial register or entered in the central register of legal persons

When there are changes to the data submitted in the declaration of commencement of activity, self-employed persons or companies must submit a declaration of changes in activity within a maximum of 15 days from the day on which the change occurred.

Companies Registered in the Business Register

Companies registered in the commercial register are exempt from submitting a declaration of changes in activity to the Tax and Customs Authority (AT), if the changes refer to:

- entry in the commercial register

- amendments to the Articles of Association as regards legal status, company name, registered office or principal place of business, capital and object

- appointment and termination of service, for any reason other than the passage of time, of management or supervisory bodies

- merger and division

- appointment and termination of office of liquidators, prior to completion of the liquidation

- appointment and dismissal of the insolvency practitioner

- winding up and closing the liquidation.

Companies Entered in the Central Register of Legal Persons

Companies entered in the central register of legal persons which are not subject to a trade register are exempt from submitting a declaration of changes in activity to the Tax and Customs Authority (TA) in the following cases:

- initial registration

- change in company name

- change in the location of the registered office, domicile or postal address

- winding up and closing the liquidation.

How to Submit the Declaration

The declaration of changes in activity must be submitted by:

- the self-employed person or company, whenever they do not have organised accounts

- the certified accountant of the self-employed person or company, should they have organised accounts.

The declaration of changes in activity may be submitted:

- via the Tax and Customs Authority website

- at any Tax and Customs Authority department

- at a Citizens’ Bureau (Loja de Cidadão), when submitted by a self-employed person.

For more information please see the Frequently Asked Questions page of the Tax and Customs Authority website or the activity amendment manual.

Reporting Termination of Activity

When self-employed persons and companies cease to perform tax-paying acts, they must submit the declaration of cessation of activity.

A declaration of termination of activity must be submitted within 30 days after the end of taxable activity.

Companies registered in a commercial register or registered in the central register of legal persons are exempt from submitting a declaration of termination of activity to the Tax and Customs Authority (AT).

A declaration of termination of activity must be submitted by:

- the self-employed person or company, whenever they do not have organised accounts

- the certified accountant of the self-employed person or company, should they have organised accounts

The declaration of termination of activity may be submitted:

- via the Tax and Customs Authority website

- at any Tax and Customs Authority department

- at a Citizens’ Bureau (Loja de Cidadão), when submitted by a self-employed person.

For more information please see the Frequently Asked Questions page of the Tax and Customs Authority website or the activity termination manual.

Calculating the Taxable Amount When Trading Goods and Services

The taxable amount on the sale of goods and the supply of services is the value received by the seller or supplier in exchange for the goods or services supplied without Value Added Tax (VAT).

The taxable amount includes:

- taxes, duties, fees and other charges

- incidental costs charged, e.g. commissions, packaging, transport, insurance and advertising

- subsidies linked to the price of the transaction, set before the sale or provision of services takes place and established on the basis of the number of units transmitted or the volume of services rendered.

The taxable amount does not include:

- Value Added Tax (VAT)

- interest on payment in instalments and amounts received as compensation defined in court for non-payment of responsibilities

- discounts, rebates and bonuses granted

- the amounts paid by the buyer of the goods or service, recorded by the seller or service provider in the appropriate accounts of third parties

- the packaging values, provided that the invoice contains information that their return has been agreed.

Where the information necessary to determine the taxable amount is not in euro, the exchange rate to be used is the last rate published by the European Central Bank or the sell rate used by any bank established in the national territory.

When the payment is not made in full or is made partly in cash

- The taxable amount is the amount paid in cash plus the open market value of the goods or services supplied in exchange.

- The open market value of goods or services is the value which would be paid for the goods, for the supply of the service or for similar goods or services.

- In the absence of a similar situation, the open market value may not be lower than the purchase price of the goods. In the absence of a purchase price, the open market value may not be lower than the production price of the goods.

- In the absence of a similar service, the open market value may not be lower than the cost of providing the service.

For more information, please refer to Article 16 of the Value Added Tax (VAT) Code.

Archiving Value Added Tax (VAT) Transactions

Time limit for archiving transaction records

- Business owners must keep transaction records for 10 years.

- If the tax settlement period is longer than 10 years, the recording of transactions has to be maintained until the end of the settlement period.

- If accounting or billing is carried out in computerised form, it is mandatory to keep documentation relating to the analysis, programming and implementation of computer processing and back-up data for billing and accounting programmes during the period for which transaction records are mandatory.

- More information can be found on the Tax and Customs Authority website.

Location of archived transaction records

- Companies or self-employed persons with an address in Portugal

- If invoices, books, records and other documents are available on paper, they have to be stored in Portugal.

- If business owners have more than one establishment, they can centralise the documents of all establishments in the same archive.

- If invoices, books, records and other documents exist in electronic form, they must be stored in any Member State of the European Union.

- The archive location, whether in paper or electronic form, must be indicated in the declaration of commencement of activity or declaration of changes in activity.

- More information can be found on the Tax and Customs Authority website.

Companies or self-employed persons without an address in Portugal

- Companies or self-employed persons without an address in Portugal may store invoices, books, registers and other documents, in paper or electronic form, in any Member State of the European Union.

- The archive location, whether in paper or electronic form, must be indicated in the declaration of commencement of activity or declaration of changes in activity.

- More information can be found on the Tax and Customs Authority website.

Storing archives outside the European Union

- Any company or self-employed person wishing to store records of transactions, whether in paper or electronic form, outside the European Union must request prior authorisation from the Tax and Customs Authority (AT) via the Tax and Customs Authority website.

- More information can be found on the Tax and Customs Authority website.

Refund of Value Added Tax (VAT) in Portugal

In Portugal, there are three rates of Value Added Tax (VAT):

- a reduced rate of 6% in mainland Portugal, 4% in the Autonomous Region of the Azores and 5% in the Autonomous Region of Madeira for goods and services in List I of the Value Added Tax Code

- an intermediate rate of 13% in mainland Portugal, 9% in the Autonomous Region of the Azores and 12% in the Autonomous Region of Madeira for goods and services in List II of the Value Added Tax Code

- a standard rate of 23% in mainland Portugal, 18% in the Autonomous Region of the Azores and 22% in the Autonomous Region of Madeira for all remaining goods and services.

For more information, please refer to Article 18 of the Value Added Tax (VAT) Code.

Exemption From Value Added Tax (VAT) in Portugal

Exemption for trade and services sectors

Trade in and supply of certain goods and services is exempt from payment of Value Added Tax (VAT) in Portugal. Some examples are:

- the provision of services by health professionals

- the provision of services by kindergartens, free-time activity centres, residential homes and day care centres for the elderly

- the supply of services by non-profit-making organisations operating establishments or facilities for artistic, sporting or entertainment activities.

The list of all activities exempt from value added tax (VAT) can be consulted in Article 9 of the Value Added Tax (VAT) Code.

Exemption for low turnover

Companies or self-employed persons are exempt from the payment of Value Added Tax (VAT) when they have a turnover of less than:

- EUR 10 000 if activity started before 31 March 2020

- EUR 11 000 if activity started after 1 April 2020

- EUR 12 500 if activity starts as of 2021.

If a company or self-employed person meets the requirements for inclusion in the special scheme for small retailers turnover may not exceed EUR 12 500 irrespective of the date of commencement of activity.

In addition to the turnover limit, companies and self-employed persons must:

- not have, and not be required to have organised accounts for personal income tax purposes

- not import or export products

- not market or provide services in the waste, scrap and recycling sector.

For more information, please refer to Article 53 of the Value Added Tax (VAT) Code.

Exemption for small traders

The Special Scheme for Small Retailers, intended for small traders, grants exemption from payment of Value Added Tax (VAT) to self-employed persons who must meet the following conditions:

- not have, and not be required to have organised accounts for personal income tax purposes; accounts must be maintained whenever annual income is estimated to be more than EUR 200 000; should lower income have been predicted, you may opt for organised accounting at any time

- have not purchased more than EUR 50 000 from suppliers in the previous year (if activity is just starting, the forecast for the current year should be used)

- at least 90% of the purchase volume has to be applied to goods intended for sale without further processing

- not import or export goods or services within the European Union

- not exceed EUR 250 in non-tax-exempt activities

- not market or provide services in the waste, scrap and recycling sector.

For more information, please refer to Article 60 of the Value Added Tax (VAT) Code.

Paying Value Added Tax (VAT)

In order to pay Value Added Tax (VAT) in Portugal, companies or self-employed persons have to submit a periodic declaration.

The declaration must be submitted:

- quarterly for companies or self-employed persons with a turnover of less than EUR 650 000 in the previous calendar year

- monthly for companies or self-employed persons with a turnover exceeding EUR 650 000 in the previous calendar year.

Companies or self-employed persons submitting on a quarterly basis (turnover of less than EUR 650 000) may, in their declaration of commencement or change of activity, opt for monthly submission.

- If monthly submission is chosen, this scheme must be maintained for at least 3 years.

- Quarterly declarations must be submitted by the 15th day of the second month following the quarter to which the declaration relates.

- Monthly declarations must be submitted by the 10th day of the second month following the month to which the declaration relates.

- Periodic declarations are submitted via the Tax and Customs Authority website.

For more information, please refer to Article 41 of the Value Added Tax (VAT) Code.

Portuguese residents are subject to tax on their worldwide income and non-residents are subject to Portuguese tax on their Portuguese-sourced income. A double taxation treaty may, of course, provide a variation to these rules.

- Portuguese residents and non-residents earning Portuguese-sourced income are subject to personal income tax (PIT). The tax rates for 2021 range from 14.5 percent to 48 percent. There is also an additional solidarity surcharge that will be levied as follows:

- 2.5 percent on the annual taxable income between EUR80,000 and EUR250,000

- 5 percent on the annual taxable income exceeding EUR250,000.

- The income is allocated to one of six categories depending on the type of income. For residents, overall income is computed by adding together the income of all the relevant categories. Income from certain categories is subject to special tax rates and excluded from overall income.

- Non-residents are subject to a 25 percent flat tax rate on employment income derived from Portuguese sources. Other income is also subject to flat rates that may vary between 10 percent and 28 percent.

- The official currency of Portugal is the Euro (EUR).

Herein, the host country/jurisdiction refers to the country/jurisdiction to which the employee is assigned. The home country/jurisdiction refers to the country/jurisdiction where the assignee lives when they are not on assignment.

Income Tax

Salary earned from working abroad

Taxation of investment income and capital gains

Additional capital gains tax (CGT) issues and exceptions

General deductions from income

Tax returns and compliance

When are tax returns due? That is, what is the tax return due date?

The Portuguese annual personal income tax return should be filed with the tax authorities, through the Internet, within 1 April to 30 June – regardless of the type of income received in the previous year.

In the situations where the taxpayer is entitled to a tax credit in Portugal (to eliminate international double taxation) on the foreign source income received, and the information on the final tax due is not available within the previous deadline, the tax return may be filed up to 31 December. In order to apply for this extension, the taxpayer must file a specific form with the tax authorities until 30 June.

What is the tax year-end?

31 December.

What are the compliance requirements for tax returns in Portugal?

Residents

The Portuguese fiscal year for individuals is the calendar year. Portuguese residents – either for the full year or part-year residents – are required to file an annual tax return between 1 April and 30 June each year.

As of 1 January 2015, the general rule is that married couples are taxed separately, and the personal income tax due will be assessed individually. However, both married couples and living together couples have the option to be taxed jointly. In this last case, if one spouse is resident only for part of the year, they must report the income received until the last day of staying in Portugal, whereas the resident spouse may file a tax return (only including their personal income received) separately, regarding the whole year.

Withholding tax levied on most income is deemed as payment on account of year-end’s tax liability and taken into consideration in the annual assessment.

The final tax assessment has to be issued up to 30 July.

Non-Resident

Non-resident taxpayers are only required to file tax returns when earning Portuguese-sourced income not subject to withholding tax at the applicable flat rates, when they have the nature of final rates.

Tax rates

What are the current income tax rates for residents and non-residents in Portugal?

Residents

Income tax table for 2021

| Taxable income bracket | Total tax on income below bracket | Tax rate on income in bracket | |

| From EUR | To EUR | EUR | Percent |

| 0.00 | 7,112 | 0.00 | 14.5 |

| 7,112 | 10,732 | 604.54 | 23 |

| 10,732 | 20,322 | 1,194.80 | 28.5 |

| 20,322 | 25,075 | 2,515.63 | 35 |

| 25,075 | 36,967 | 3,017.27 | 37 |

| 36,967 | 80,882 | 5,974.54 | 45 |

| Over 80,882 | 8,401.21 | 48 | |

Non-residents

| Income (Portuguese source) | Tax rate (percent) |

| Employment income | 25 |

| Business and professional income | 25 |

| Interest | 28 |

| Dividend | 28 |

| Capital gains on sale of shares | Tax exempt or 28* |

| Capital gains on sale of real estate/ moveable assets | 28* |

| Rental income | Between 10 and 28* |

| Pension income | 25 |

Non habitual residents

| Income (Portuguese source) | Tax rate (percent) |

| Employment income** | 20 |

| Business and professional income** | 20 |

| Interest | 28 |

| Dividend | 28 |

| Capital gains on sale of shares | 28 |