BEA – Acquisition and Ownership

Currently, the U.S. does not tax, or impose a filing

obligation on, the acquisition or mere ownership of U.S. real property by a

foreign person. The U.S. Department of Commerce’s Bureau of Economic Analysis

(BEA), however, requires that certain surveys be completed by foreign persons

who own substantial holdings of U.S. real property. These surveys are issued

and collected by the BEA for purposes of gathering statistical data on foreign

investment in the United States and can be summarized generally as follows:

- quarterly reporting of certain positions and

transactions concerning the U.S. real property and its foreign owner(s), and

foreign affiliates of its foreign owner(s), on the Quarterly Survey of

Foreign Direct Investment in the United States (Form BE-605); - annual reporting of financial and operating data

concerning the U.S. real property on the Annual Survey of Foreign Direct

Investment in the United States (Forms BE-15A, BE-15B, BE-15(EZ), and

BE-15 Claim for Exemption); and - benchmark reporting every five years of financial and

operating data, positions, and transactions concerning the U.S. real property

and its foreign owner(s), and foreign affiliates of its foreign owner(s), on

the Benchmark Survey of Foreign Direct Investment in the United States (Forms

BE-12(LF), BE-12(SF), BE-12 Bank, BE-12 Mini, and BE-12 Claim for Not Filing).

A foreign person’s obligation to complete these surveys

depends on the aggregate fair market value of all U.S. real property that he or

she owns (or the total sales, operating revenues, or net income from such

property). The filing thresholds for the BEA forms are quite high, with a

threshold of $40 million for the annual and benchmark surveys and $60 million

for the quarterly survey. The nuances of these surveys are also rather

convoluted, so it is advisable to visit the BEA web site for guidance (current

reporting requirements can be found at

www.bea.gov/surveys/pdf/2010current_Reporting_ Requirements.pdf).

Estate Taxes

Any U.S. property owned by a foreign trust is not subject to

U.S. estate taxes (or many state death taxes) on the death of the settlor of

the trust unless

(a) the trust is a “grantor trust,” or

(b) the settlor of the

trust had certain retained powers over or interests in the trust on the date of

death

If an NRA possesses the right to revoke the trust, or

possesses any of the proscribed powers or interests in any U.S. property held

by the trust on the date of his death, he will be subject to U.S. estate taxes

(and any applicable state death taxes).

One drawback to the use of a foreign irrevocable trust is

that, unlike a corporation, the trustee does not have limited liability for all

of the trust’s debts.

LLC

One way to avoid this problem is for the trust to create a

wholly-owned U.S. limited liability company (“LLC”) to own the real estate. The

LLC is a common form of U.S. ownership entity permitted in nearly all U.S.

states. It combines the attractive attributes of limited liability for the

owners (“members”) and management by the members or designated “managers.”An

irrevocable foreign trust may thus establish a wholly-owned LLC as the owner of

U.S. real estate, thus affording the trustee and beneficiaries with limited

liability protection and allowing them to use a familiar U.S. entity in dealing

with U.S. contract parties

One tax attribute of an LLC may be quite advantageous: LLCs

with a single owner are treated as “disregarded entities,” which are treated by

the IRS as if they did not exist for U.S. income tax purposes. A U.S.Tax

Court case suggests that a membership interest in a single-member LLC may be

treated as a separate U.S. entity for estate and gift tax purposes, but this

would not result in estate or gift taxation of a foreign irrevocable trust.

Ownership of real estate through a single member LLC is also a good way of

preserving the confidentiality of the identities of the trust’s owners.

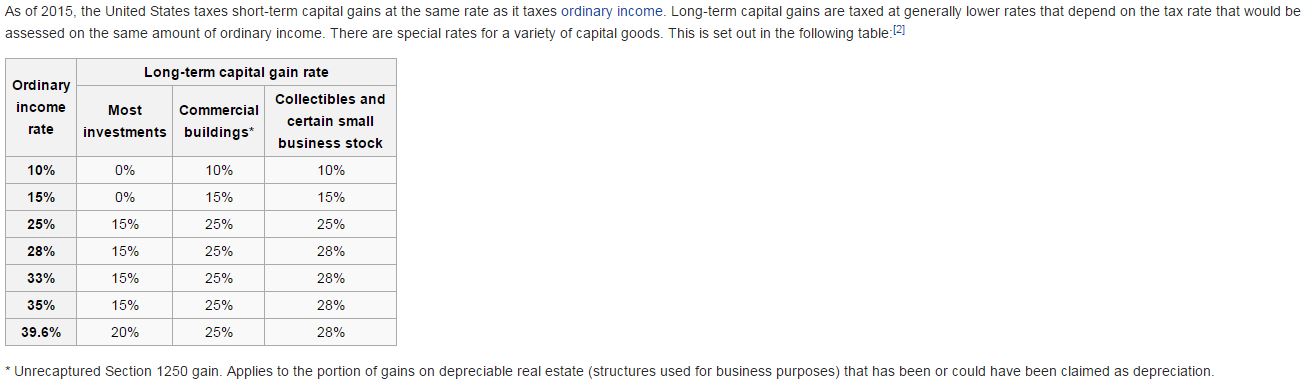

Capital Gains

Income Tax

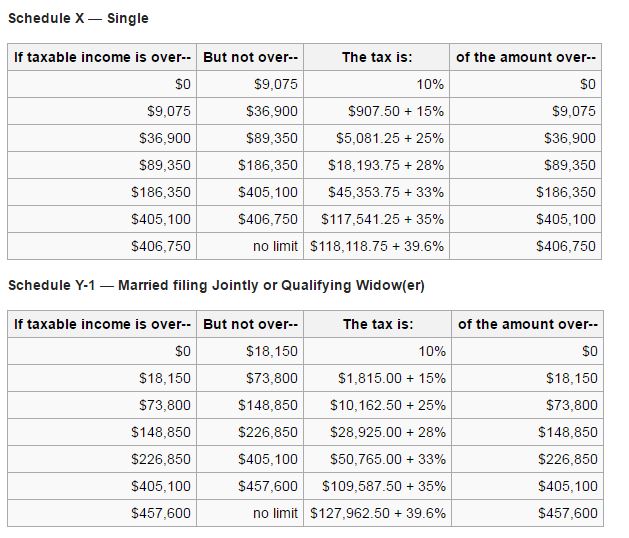

Trusts are considered as separate taxable entities, but are

entitled to a deduction for income actually distributed to beneficiaries.

Beneficiaries are taxable on distributed income at ordinary individual income

tax rates. A Trust is not taxed on

income distributed to its beneficiaries; rather, the beneficiaries are taxed on

the distributed income in the same manner as U.S. resident individuals.

Undistributed income of a trust is subject to U.S. income

tax at a graduated rate schedule as follows:

Trust Income Tax Rates (2015)

Taxable Income Tax Rate

$0 to $2,500 15%

$2,501 to $5,900 25%

$5,901 to $9,050 28%

$9,501 to $12,300 33%

$12,301 and over 39.6%

The principal deductions allowed in computing net income

from real estate rentals are:

• local real estate taxes;

• state income taxes;

• insurance;

• depreciation;

• condominium fees; and

• interest (subject to the “earnings stripping” rules).

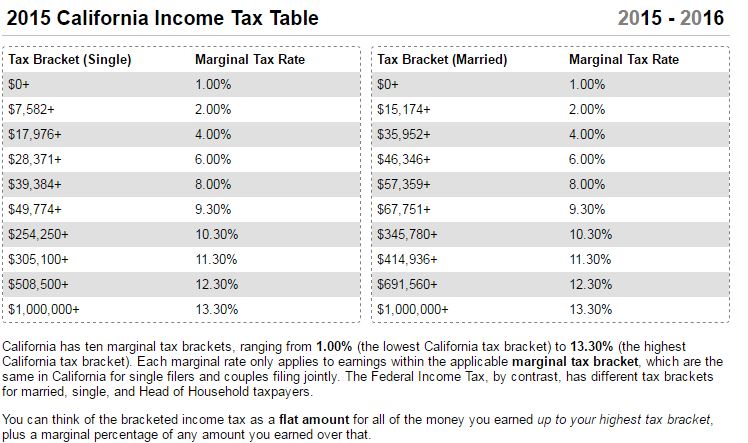

A Note on California – Income Taxes / Capital Gains Taxes